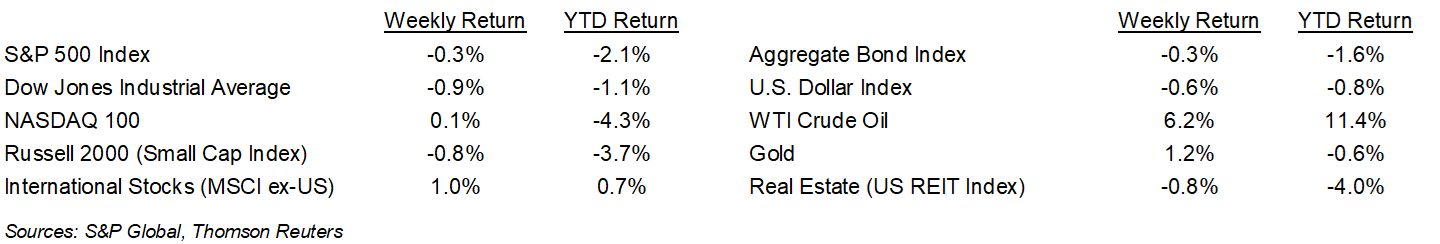

January 17th is deemed Quit Day, or Ditch New Years’ Resolution Day, because it is typically the day most people have already left behind their resolutions. People typically do this because it is hard to maintain their discipline. While the first two weeks of January have been tough in the financial markets as well, we’d urge investors to maintain their discipline and persevere. The equity markets were mixed in the second week of the year. The S&P 500 Index ended the week -0.3%, the Dow was -0.9%, and the NASDAQ eked out a +0.1 return. The U.S. 10-year Treasury bond yield increased to 1.793% at Friday’s close versus 1.766% the previous week.

Fed Chairman Jerome Powell spoke at his Senate confirmation hearing last week. He clarified a few items that caused concern from the December Fed meeting minutes. He said he thinks the Fed will end asset purchases in March, raise rates over the course of the year, and allow the balance sheet to run off later in the year. This last item, that balance sheet run off would occur later in the year, was enough to calm the markets as it means the Fed won’t reduce liquidity in the markets too quickly. The concern raised by the Fed meeting minutes was that balance sheet run off would occur simultaneously with rate hikes.

For the fourth quarter of 2021, 26 companies have reported earnings results and 76.9% have reported earnings above analyst estimates. This compares to a long-term average of 65.9% and prior four quarter average of 83.9%. The current consensus forecast is for fourth quarter earnings to grow 23.1% on 12.2% revenue growth versus an expectation of 22.4% earnings growth on 12.1% revenue growth at the start of the earnings season. During the coming week, 40 more companies in the S&P 500 Index are scheduled to report earnings.

In our Dissecting Headlines section, we look at the sector level growth expectations for the S&P 500 Index.

Financial Market Update

Dissecting Headlines: Sector Level Earnings Outlook

The current consensus forecast is for 4Q21 earnings to grow 23.1% on 12.2% revenue growth. These year/year comparisons vary by sector as we are still in year/year comparison to an economy impacted by COVID restrictions.

The Energy sector, while a small part of the S&P 500 Index at 2.7%, has a large impact on the 23.1% earnings growth as it was negative in the fourth quarter of 2020. It has rebounded strongly supported by the price of oil and return of travel to near normal levels. Excluding the Energy sector, the remainder of the S&P 500 Index is forecasted to grow earnings by 15.1%.

Outside of Energy, other cyclical sectors, such as Industrials and Materials, are expected to grow earnings substantially with Materials +63.9% and Industrials +52.4%. Again, this is the impact of a normalizing economy as COVID has subsided.

Sectors which were steadier during COVID, such as Consumer Staples and Utilities, should experience more subdued earnings growth with Consumer Staples +3.5% and Utilities +0.7%.

Information Technology is the S&P 500’s largest sector with a 29.2% weighting. Information Technology earnings are expected to grow 15.6% for the fourth quarter.

________________________________________

Want a printable version of this report? Click here: NovaPoint January 17, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.