Equity markets gained last week after supportive comments from Federal Reserve Chairman Jerome Powell that the Fed could start slowing the pace of interest rate increases. The S&P 500 was +1.2% for the week, the Dow was +0.4%, and the NASDAQ was +2.1%. The 10-year U.S. Treasury note yield decreased to 3.503% at Friday’s close versus 3.702% the previous week.

Speaking at the Brookings Institution last Wednesday, Fed Chair Jerome Powell indicated the Federal Open Market Committee (FOMC) was in a position to reduce the size of rate hikes as soon as the December meeting. He did caution, however, that monetary policy is likely to be restrictive for some time until real signs of progress emerge on inflation. The Fed is likely to keep its data dependent posture into the first quarter of 2023.

The labor market has remained strong. The economy produced 263,000 new jobs in November and the unemployment rate stands at 3.7%. Continued strength in the labor market provides incentive for the Fed to keep raising interest rates.

For this week, we will see a first look at inflation for November with the Producer Price Index (PPI) scheduled for Friday. The November Consumer Price Index (CPI) is scheduled for next Monday, just days ahead of the December FOMC meeting.

In our Dissecting Headlines section, we look at the impact of the November employment report.

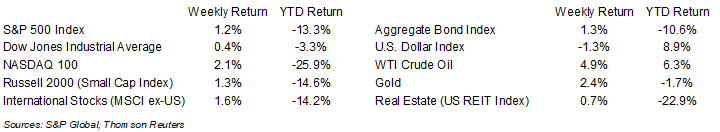

Financial Market Update

Dissecting Headlines: Inside Jobs

The economy produced 263,000 new jobs in November and the unemployment rate stands at 3.7%. The strength in the labor market is a positive for GDP, as approximately two-thirds of U.S. GDP is consumer spending based. However, continued demand for workers, potentially at higher wage levels, can be a contributing factor to the inflation that the Fed is busy trying to contain.

November’s non-farm payrolls of 153.5 million are above the pre-pandemic level of 152.5 million from February 2020. Despite two quarters of GDP contraction in the first half of 2022, the U.S. economy continues to grow jobs even as the Fed is raising interest rates to slow the pace of inflation. Much of the job growth has been in areas such as leisure and hospitality where employment has nearly doubled from a pandemic low of 8.8 million in April 2020 to a post-pandemic high of 16.0 million jobs in November. This is still below the pre-pandemic level of 17.0 million in February 2020.

When we hear large layoff announcements from major companies in the S&P 500 Index, we need to understand the context that the combined employment within the S&P 500 Index is less than 20% of the total U.S. workforce. Outside of the S&P 500 employers and the government, most Americans are employed by small to medium-sized businesses.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly December 5, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.