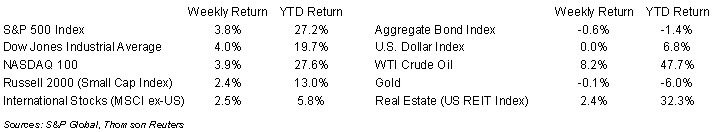

Concern surrounding the omicron variant subsided last week and it helped the equity markets bounce off support levels. The S&P 500 Index finished the week +3.8%, the Dow was +4.0% and the NASDAQ was +3.9%. The U.S. 10-year Treasury bond yield increased to 1.478% at Friday’s close versus 1.356% the previous week.

The Federal Reserve’s Federal Open Market Committee (FOMC) meets on Wednesday for the final time in 2021. Fed Chair Jerome Powell recently testified to the Senate that the Fed may need to accelerate its timeline for the tapering of monthly bond purchases. This action could also accelerate the timing of the Fed’s first increase in short-term interest rates. We had thought an initial interest rate increase wouldn’t come until mid-year 2022. An accelerated taper could move that into the second quarter of the year. As part of the meeting, the FOMC will publish its quarterly Summary of Economic Projections. This aggregated view of all FOMC members provides an indication of what they deem appropriate monetary policy to be for the next few years. Changes in projections for these indicators, such as employment, inflation, and GDP growth can lend support to decisions for changes in interest rate policy.

With the year nearly over, the focus in equities should shift to the fourth quarter earnings reports that start in January. The current outlook for the S&P 500 Index for the fourth quarter is earnings growth of 22.0% on 11.9% revenue growth.

In our Dissecting Headlines section, we look at the historical impact of the Santa Claus Rally.

Financial Market Update

Dissecting Headlines: Santa Claus Rally

With Christmas on the way, one investing question that comes along this time of year is whether or not there will be a Santa Claus Rally in the stock market. The Santa Claus Rally is a year-end phenomenon where investors are looking for better than coal in their investment stockings. According to the Stock Trader’s Almanac, the time period to measure the rally is the five final trading days of the year and the first two trading days of January. Since 1950, the S&P 500 Index has recorded a positive return on 56 occasions. The average increase over those seven trading days has been +1.3%. Whether it is optimism surrounding the U.S. consumer spending money, institutional positioning ahead of the new year, or just the holiday spirit, the impact has been a positive one over the years.

________________________________________

Want a printable version of this report? Click here: NovaPoint December 13, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.