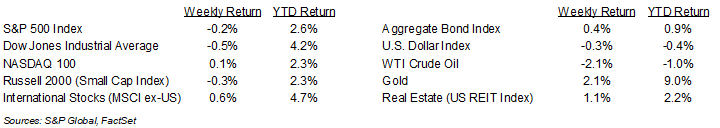

Mexico and Canada made border security concessions to avoid tariffs going into effect, but more tariff proposals may be looming for other countries. For the week, the S&P 500 Index was -0.2%, the Dow Jones Industrials -0.5%, and the NASDAQ +0.1%. The S&P 500 Index was led by the Consumer Staples, Real Estate, and Energy sectors, while the Consumer Discretionary, Communication Services, and Industrial sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.488% at Friday’s close versus 4.546% the previous week.

The January Employment Report showed 143,000 new jobs created. While this was below the expectation of 169,000, the December job total was revised up by 51,000 and the January unemployment rate fell to 4.0%. This data has pushed out expectations for a Federal Reserve rate reduction past the first half of the year. Progress on inflation is back in focus this week with the January Consumer Price Index (CPI) scheduled for Wednesday and Producer Price Index (PPI) scheduled for Thursday.

We are past the halfway point for the fourth quarter earnings reporting period. Another 78 companies in the S&P 500 Index scheduled to report earnings this coming week. Fourth quarter earnings growth is currently forecast at 16.4% year-over-year with revenue growth of 5.2%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 10.1% with revenue growth of 5.2%. Full-year 2025 earnings are expected to grow by 13.0% with revenue growth of 5.5%.

In our Dissecting Headlines section, we look at Valentine’s Day spending trends.

Financial Market Update

Dissecting Headlines: Valentine’s Day Spending

According to a recent National Retail Federation’s (NRF) survey, consumers are expected to spend $27.5 billion on Valentine’s Day this year. This is a $1.7 billion increase from last year. For 2025, the per-person average spend is expected to be $188.81. In total, 56% of consumers surveyed plan to celebrate Valentine’s Day this year, a 3% increase from 2024. Notably, 55% of men stated they plan to celebrate the holiday this year, a 4% increase from 2024.

In terms of where consumers are shopping, 38% plan to shop online, followed by 34% at department stores, 29% at discount stores, and tied for 18% to florists and specialty stores. The most popular gifts to be bought this year include candy at 56%, flowers and greeting cards at 40% each, a special evening out at 35%, and jewelry at 22%.

Over the last decade, there has been an increasing trend to not only celebrate Valentine’s Day with your significant other, but to share the holiday, and thus consumer spending, with friends, co-workers, children, and other family members. Specifically, 32% of consumers say they plan to buy gifts for friends, a 4% increase from last year and the highest rate in the survey’s history. Spending for co-workers has risen to a record high of 19%. Lastly, although level from the prior year, 32% of consumers say they will also purchase gifts for their pets.

Another increasing trend is for those that state they don’t celebrate Valentine’s Day to still participate in consumer spending by treating themselves to a special service or gift, followed by having a special outing with friends and/or family that are also single.

Taking into consideration that Valentine’s Day this year lands on the Friday of Presidents’ Day weekend, additional consumer spending can be expected due to a well-established practice of retailers offering various and competitive consumer discounts over the holiday weekend.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly February 10, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.