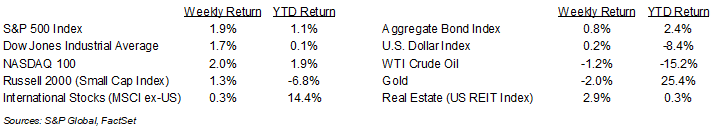

Equities posted a positive week, capping off a strong May recovery that pushed the major U.S. indices into positive territory for the year. For the week, the S&P 500 Index was +1.9%, the Dow Jones Industrials +1.7%, and the NASDAQ +2.0%. For the month, the S&P 500 Index was +6.3%, the Dow Jones Industrials +4.2%, and the NASDAQ +9.1%. The Real Estate, Technology, and Communication Services sectors led the S&P 500 Index for the week, while the Energy, Materials, and Utility sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.390% at Friday’s close versus 4.508% the previous week.

April Personal Consumption Expenditures (PCE) Prices showed that tariffs have yet to make a meaningful inflation impact. Prices were +0.1% month-over-month and +2.1% year-over-year. Core PCE, which excludes the impact of food and energy prices, was +0.1% month-over-month and +2.5% year-over-year. This week’s economic data includes the May Employment Situation Report. That report, plus reports on inflation the following week, should set the stage for the June 18th Federal Open Market Committee (FOMC) meeting where the committee is expected to keep the Fed funds rate steady in the current 4.25% to 4.50% target range but lay out a policy path for the remainder of the year. Current CME Fed funds futures show a total of 0.50% in reductions in the Fed funds rate forecast for 2025.

The first quarter earnings reporting period is almost complete with 98% of companies having reported results. This week eight companies in the S&P 500 Index are scheduled to report earnings results. First quarter 2025 earnings growth is currently forecast at 13.1% year-over-year with 4.9% revenue growth. Full-year 2025 earnings are expected to grow by 9.1% with revenue growth of 4.9%.

In our Dissecting Headlines section, we review the Federal Reserve’s dual mandate for setting monetary policy.

Financial Market Update

Dissecting Headlines: Dual Mandate

Spending cuts, tariffs and trade negotiations, the budget and tax cuts all fall under fiscal policy and are the task of the executive and legislative branches. The Federal Reserve controls monetary policy which includes setting the Fed funds rate, open market operations, and other policy tools.

The Fed’s monetary policy goals are based on the dual mandate of achieving price stability and maximum employment. Price stability is controlling inflation and the Fed has expressed a goal of averaging 2% in annual inflation, based on the PCE Price Index. The April PCE Price Index showed a 2.1% annual increase in prices. The Fed has expressed caution over the current tariff policies saying they could increase inflation. Maximum employment doesn’t have an exact numerical target, but the Fed wants the labor market to be fluid, neither causing high unemployment nor significant wage inflation. The April unemployment rate was 4.2% and the Labor Department is scheduled to release May data this coming Friday.

Fed Chairman Jerome Powell has consistently reiterated that monetary policy decisions will be data driven. His concern appears to be what is not yet in the data, the impact of tariffs on inflation and potentially employment. The Federal Reserve is expected to keep rates steady at its June 18th meeting. It will also issue a revised set of economic projections and recommended policy path for the remainder of the year. That should provide good insight to the balance of the dual mandate in the current fiscal policy environment.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly June 2, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.