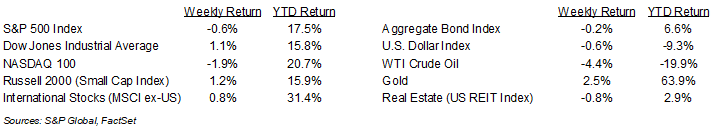

The Federal Reserve followed-through and provided an interest rate cut but concerns over the AI trade left markets mixed last week. The S&P 500 Index finished last week -0.6%, the Dow Jones Industrials +1.1%, and the NASDAQ -1.9%. The Materials, Financials and Industrials sectors led the S&P 500 Index, while the Communication Services, Technology, and Utility sectors lagged. The 10-year U.S. Treasury note yield was 4.192% at Friday’s close versus 4.139% the previous week.

The Federal Reserve reduced short-term interest rates by 0.25% to a 3.50% to 3.75% target range at its December policy meeting. The updated Summary of Economic Projections sees one additional 0.25% reduction in 2026 which CME Fed funds futures are currently forecasting for March.

The government is still playing catch-up on backlogged economic data. Scheduled releases for this week include the November Employment Situation Report, October and November Retail Sales, and September Housing Starts.

Fourteen companies in the S&P 500 Index are scheduled to report fourth quarter earnings this week. For the fourth quarter, S&P 500 Index earnings are expected to grow by 8.1% with revenue growth of 7.5%. Full-year 2025 earnings are expected to grow by 12.1% with revenue growth of 6.9%.

In our Dissecting Headlines section, we look at the key takeaways from last week’s Federal Reserve policy meeting.

Financial Market Update

Dissecting Headlines: Fed Meeting Summary

The Federal Reserve reduced short-term interest rates by 0.25% to a 3.50% to 3.75% target range. This was the third rate cut of the year, totaling 0.75%. The total for rate cuts in 2024 was 1.00%. It may be distant memory, but the Fed funds rate target range was 5.25% to 5.50% in mid-2023.

The vote was 9-3 to lower rates by 0.25% with two dissents for no action, from Chicago Fed president Austan Goolsbee and Kansas City Fed president Jeffrey Schmid, and one vote for a 0.50% cut from Fed governor Stephen Miran.

In addition to lowering interest rates, the Fed also announced it will resume buying Treasury securities. It will start by buying $40 billion in Treasury bills here in December. Purchases are expected to continue for several months. The Fed will make an announcement around the 9th of each month of its planned purchases for a 30-day cycle.

The updated Summary of Economic Projections shows one additional 0.25% rate cut in 2026. The changes in the economic outlook for 2026 are Gross Domestic Product (GDP) rising to growth of 2.3% versus prior expectation of 1.8% for 2026 and 1.7% in 2025, unemployment at 4.4% for 2026 which was no change from prior expectation and versus 4.5% for 2025, and inflation at 2.4% for 2026 versus 2.6% prior expectation and 2.9% for 2025 with 2026 core inflation at 2.5% versus 2.6% prior expectation and versus 3.0% for 2025.

The policy debate heading into 2026 remains split between supporting a declining labor market versus guarding against a resurgence of inflation.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly December 15, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.