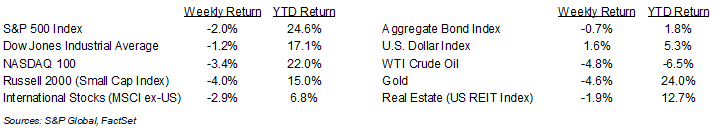

Stocks gave back some of their post-election gains as concerns over the pace of interest rate cuts by the Federal Reserve emerged based on comments from Fed Chair Jerome Powell. For the week, the S&P 500 Index was -2.0%, the Dow Jones -1.2%, and the NASDAQ -3.4%. The Financial, Energy, and Utility sectors led the market, while the Health Care, Materials, and Technology sectors lagged. The 10-year U.S. Treasury note yield increased to 4.441% at Friday’s close versus 4.228% the previous week.

In a speech last week, Powell said the economy is not sending any signals that the Federal Reserve needs to be in a hurry to lower rates. While he confirmed that the Fed is planning to return to a neutral stance on monetary policy, it will be a data dependent path. October Consumer Price Index (CPI) data showed inflation +0.2% month-over-month and +2.6% year-over-year. Core CPI, which excludes food and energy prices, was +0.3% month-over-month and +3.3% year-over-year. Current CME Fed funds futures still show a 0.25% reduction predicted for the December Federal Open Market Committee (FOMC) meeting on December 18th. At that point, the FOMC should issue an updated Summary of Economic Projections, providing a road map for the first quarter of 2025. Fed funds futures for the first quarter currently show a 0.25% reduction in interest rates.

We are 93% of the way through the third quarter earnings reporting period. Reports continue this week with 14 companies in the S&P 500 Index scheduled to release results. Third quarter earnings growth is currently forecast at 5.4% year-over-year with revenue growth of 5.5%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 9.3% with revenue growth of 5.0%.

In our Dissecting Headlines section, we look at the Thanksgiving travel forecast.

Financial Market Update

Dissecting Headlines: Thanksgiving Travel Forecast

The American Automobile Association (AAA) projects 79.86 million travelers will head 50 miles or more from home over the Thanksgiving holiday travel period, a 2.1% increase versus 2023.

Volumes are expected to increase across all major modes of travel. Auto, the largest category, is expected to increase 1.9% year-over-year to 71.74 million travelers. Air travel is expected to increase 1.9% to 5.84 million. All other travel, which includes train, bus, and cruise, is expected to increase 9.1% to 2.28 million, with cruise bookings 20% higher year-over-year.

Annual changes in cost of travel varies. The current average price of regular gasoline nationwide is $3.071 per gallon, down 7.5% year-over-year. The average price of a domestic flight is 3% higher year-over-year while international flights are down 5%. Based on data from the recent Consumer Price Index (CPI) report, hotel rooms are 0.1% lower year-over-year.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly November 18, 2024

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.