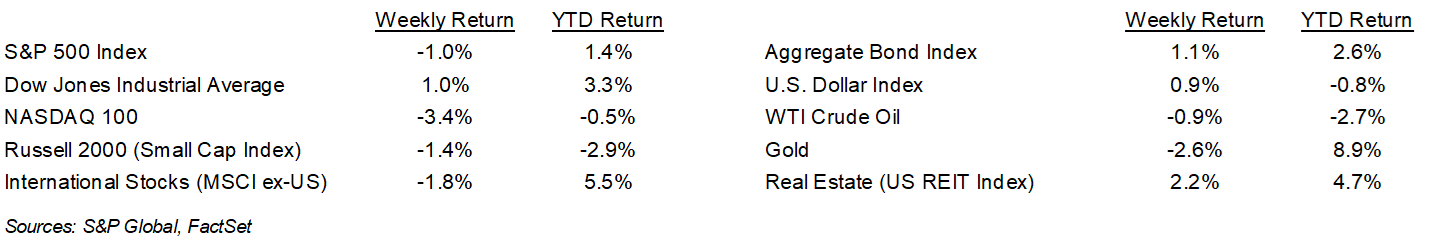

Despite a strong showing on Friday, the S&P 500 Index closed lower for both the week and month. For the week, the S&P 500 Index was -1.0%, the Dow Jones Industrials +1.0%, and the NASDAQ -3.4%. The S&P 500 Index was led by the Financial, Real Estate, and Health Care sectors, while the Technology, Communication Services, and Consumer Discretionary sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.197% at Friday’s close versus 4.425% the previous week. For the month of February, the S&P 500 Index was -1.3%, the Dow Jones Industrials -1.4%, and the NASDAQ -2.7%.

The Personal Consumption Expenditures (PCE) Price Index saw prices rise 0.3% month-over-month and 2.5% year-over-year, and core PCE prices, which exclude the impact of food and energy prices, were 0.3% higher month-over-month and +2.6% year-over-year. The PCE Price Index is the Federal Reserve’s preferred index to track inflation. The February Employment Situation Report is scheduled for this Friday. That should give the Federal Reserve a view on the labor market ahead of its March 19th policy meeting. As of now, the Fed looks to be on hold at its March meeting with no rates cuts seen until at least the June meeting. We think the Fed’s outlook will also be clearer once fiscal policy is firmly set by Congress and the Trump administration with the passing of a budget in late March or early April.

The fourth quarter earnings reporting period is almost complete. This coming week, another nine companies are scheduled to report earnings. Fourth quarter earnings growth is currently forecast at 18.2% year-over-year with revenue growth of 5.3%. For the companies that have already reported earnings, 75% have exceeded their forecasted estimates. This is roughly inline with the 5-year average of 77% and 10-year average of 75%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 10.4% with revenue growth of 5.2%. Full-year 2025 earnings are expected to grow by 12.1% with revenue growth of 5.5%.

In our Dissecting Headlines section, we look how the sectors within the S&P 500 Index have performed in February and year-to-date.

Financial Market Update

Dissecting Headlines: Sector Scorecard

With the S&P 500 Index -1.3% in February and +1.4% year-to-date, the sector rankings look a little different than they have over the past two years. The leading sectors in February were Consumer Staples +5.7%, Real Estate +4.2%, Energy +4.0%, and Utilities +1.7%. Lagging sectors for the month were Consumer Discretionary –9.4%, Communication Services –6.3%, Industrials –1.4%, and Technology –1.3%.

Year-to-date, the leading S&P 500 sectors are Health Care +8.4%, Financials +8.6%, Consumer Staples +7.9%, and Real Estate +6.1%. The lagging sectors year-to-date are Consumer Discretionary –5.4%, Technology –4.2%, Communication Services +2.3%, and Industrials +3.5%.

While struggles among some previously high flying sectors and stocks can cause concern among investors, we view a broadening of market participation among other sectors to be a healthy signal for a more coordinated advance as we move through the year.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly March 3, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.