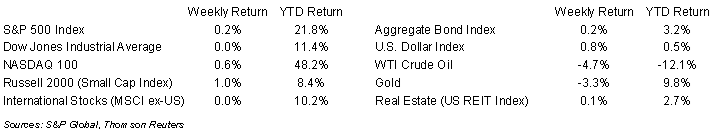

Equities rose modestly as investors await the final Federal Reserve meeting of the year. The weekly return for the S&P 500 Index was +0.2%, the Dow was flat, and the NASDAQ was +0.6%. The S&P 500 Index was led by the Consumer Discretionary, Communication Services, and Technology sectors. The Energy, Materials, and Consumer Staples sectors lagged. The 10-year U.S. Treasury note yield increased to 4.245% at Friday’s close versus 4.224% the previous week.

The Federal Reserve is widely expected to hold short-term interest rates steady at its Federal Open Market Committee (FOMC) meeting this week. The important insight may come from the Fed’s quarterly Summary of Economic Projections where economic data, to include the Committee’s view of the appropriate Fed funds rate for 2024, will be published. Current CME Fed funds futures anticipate a reduction in the Fed funds rate by May 2024.

With only three companies remaining to report third quarter earnings for the S&P 500 Index, earnings are expected to grow by 7.2% year-over-year on revenue growth of 1.8%. This is a substantial increase from the 1.6% earnings and 0.8% revenue growth forecasted at the start of the earnings reporting period. For full-year 2023, S&P 500 Index earnings are expected to grow by 2.6% on revenue growth of 2.0%. Current consensus for full-year 2024 is 11.4% earnings growth on 5.2% revenue growth.

In our Dissecting Headlines section, we look at the Summary of Economic Projections heading into this week’s FOMC meeting.

Financial Market Update

Dissecting Headlines: Summary of Economic Projections

The FOMC publishes its Summary of Economic Projections each quarter. This is the collective roadmap for how Federal Reserve officials view the economy unfolding over the next two to three years and what monetary policy actions they view as likely based on these projections. The projections are updated at the FOMC meetings each March, June, September, and December.

Underlying assumptions for 2024 in the summary, as of the September meeting, are Gross Domestic Product (GDP) growth of 1.5%, the unemployment rate at 4.1%, inflation measured by Personal Consumption Expenditures (PCE) prices of 2.5% and core inflation, which exclude food and energy prices, of 2.6%. The summary also shows the FOMC’s projected path of monetary policy, which in September anticipated a Fed funds rate in 2024 of 5.00% to 5.25% versus the current Fed funds rate target range of 5.00% to 5.25%.

With third quarter GDP growth reported at 5.2% and the November unemployment rate at 3.7%, the FOMC is currently anticipating a significant slowing of economic activity in 2024. The October PCE Price Index showed year-over-year inflation at 3.0% and core inflation at 3.5%, so the FOMC is also anticipating further slowing in the rate of inflation in 2024. The December update of the Summary of Economic Projections should give us insight to how the FOMC sees the pace of economic slowing in 2024 and how it plans to adjust interest rates to maintain its mandates of full employment and price stability in the economy.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly December 11, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.