Barring any significant disruption happening over the next two days, the equity market will be closing 2019 at, or near, record highs. Many of the worries from a year ago, such as global trade and a hawkish Federal Reserve, have dissipated. Consumer spending has been a key component of economic growth for the year. According to Mastercard SpendingPulse data holiday retail sales increased 3.4% with online sales growing 18.8%.

Looking ahead to 2020, corporate earnings growth should be positive with current consensus expectations for 9.7% growth versus 2019 for companies in the S&P 500 Index. However, we anticipate 2020 could be a noisy year in political headlines as we head into the election cycle.

In our Dissecting Headlines section, we explain an easy rule of thumb that investors can use to estimate how rates of return can impact the compounding value of financial assets.

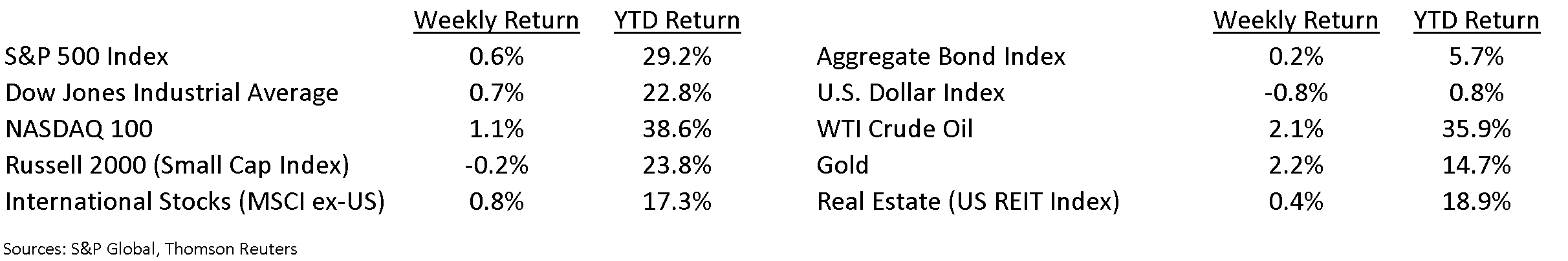

Financial Market Update

Dissecting Headlines: The Rule of 72

We often get asked, “How long should it take my portfolio to double in value?” Investment returns can vary from year-to-year, but some simple math called the Rule of 72 can be used as a guide.

The Rule of 72 states that the number of years required for an investment to double in value is equal to 72 divided by the rate of return. This takes into account the effect of compounding interest, meaning that the same rate of return is applied every year to the total of principal and return from the year prior.

Since we are at the start of a new decade, if we take 72 and divide by a 7.2% annual return (drop the percentage sign), we get 10 years for an investment to double. A higher return shortens the period and a lower return lengthens the period. The average annual return of the S&P 500 Index since 1957 (when 500 stocks were adopted as the Index) is around 8%.

Factors such as additional savings being added or withdrawals being taken could alter these numbers, as well as factors such as taxes. As we head into a new decade, you can use the Rule of 72 as a rough guide to see how your investments grow.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint December 30, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.