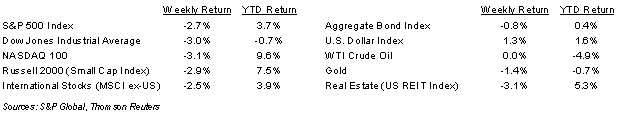

The equity markets have gone cold in February with the S&P 500 Index declining for three consecutive weeks. Last week, the S&P 500 Index was -2.7%, the Dow was -3.0%, and the NASDAQ was -3.1%. The 10-year U.S. Treasury note yield increased to 3.949% at Friday’s close versus 3.828% the previous week.

The January Personal Consumption Expenditures (PCE) Price Index increased 0.6% month-to-month and core PCE also increased 0.6% month-to-month. Year-over-year, PCE prices increased 5.4% and core PCE increased 4.7%. This report follows on the heels of higher Consumer Price Index (CPI) and Producer Price Index (PPI) for January and continues to inject some caution in investor sentiment due to actions the Federal Reserve may need to take to confront this reemergence of inflationary pressure in the economy.

Fourth quarter earnings reporting is nearing an end with 465 companies complete in the S&P 500 Index. Another 26 companies are scheduled to report earnings this week. The current consensus for fourth quarter earnings for the S&P 500 Index is a 3.2% decline in year-over-year earnings on 5.7% revenue growth. Of the 465 companies in the S&P 500 that have reported earnings to date, 67.5% have reported earnings above analyst estimates. This compares to a long-term average of 66.3% and prior four quarter average of 75.5%. For full-year 2022, current consensus is 4.8% year-over-year earnings growth on 11.6% revenue growth. The current consensus expectation for full-year 2023 is 1.7% earnings growth on 1.5% revenue growth.

In our Dissecting Headlines section, we explain supercore inflation.

Financial Market Update

Dissecting Headlines: Supercore Inflation

The sticky point in reducing inflation continues to be higher wages. The Federal Open Market Committee (FOMC) minutes from the February 1st meeting mentioned that many supply bottlenecks have freed up. We have also seen prices for many commodities decline. The remaining issue is that two-thirds of the U.S. economy is service-based and higher wages have a direct inflationary impact in the service economy. Higher wages in a still strong job market are driving up prices in these service industries is what is now being called “supercore inflation” or the inflation in labor costs after we strip away food, energy, raw materials, and all other non-labor categories.

Similar to what has historically been known as the “wage-price spiral”, the FOMC will need to create greater slack in the labor market to bring down overall prices in the economy. The January unemployment rate of 3.4% was near record lows. We will likely need to see a turn in the labor market to cool wage growth and reduce pressure on supercore inflation. The next labor market data point is the February employment report scheduled for March 10th. That report, along with the February CPI (scheduled for March 14th) and PPI (scheduled for March 15th) reports should set the stage for the March 22nd FOMC meeting.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly February 27, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.