What did you do this weekend? Some consumers purchased groceries, got takeout food, or dined at a restaurant. Some would-be travelers stayed home, where as others drove or flew on trips. Some consumers went to a mall or big box store, shopped at a small business, or received packages at their homes. The U.S. economy is a mixed bag right now, but every week we are seeing more people stepping out. With more restaurants and retailers opening, it means people are also going back to work in the hard-hit consumer sector. The halt caused by the shutdown was severe, but we are slowing seeing an increase in activity that should be reflected in economic data over the next few months.

First-time unemployment claims for the week of May 16th decreased to 2.438 million versus 2.687 for May 9th. Continuing Claims for the week of May 9th were 25.073 million, up from 22.548 million for May 2nd. The eventual decline in continuing claims for unemployment for reasons cited above should provide some input on the pace of economic recovery.

We are nearly done with the first quarter earnings reporting period. To date, 478 companies in the S&P 500 have reported first quarter earnings with 65% have beaten reduced expectations and 30% have reported below. This week 14 companies in the S&P 500 are scheduled to report earnings. Current consensus is for earnings to be down 12.6% year over year. Consensus for second quarter earnings are currently at a 42.4% reduction year over year. The bulk of the COVID damage has occurred in the second quarter and we anticipate that to be the low point in the economy. The stock market tends to anticipate forward earnings potential and is likely looking through the COVID-19 crisis to some extent. Market volatility should remain over the coming months as a mix of positive and negative indicators are likely to cause steps forward and steps back along the road to recovery.

Both Fed Chairman Jerome Powell and Treasury Secretary Steven Mnuchin testified in front of the Senate last week to give their assessment on the progress of the economy and the CARES Act. In our Dissecting Headlines section we look at how Monetary Policy by the Federal Reserve and Fiscal Policy by the Administration and Congress are used to manage the economy.

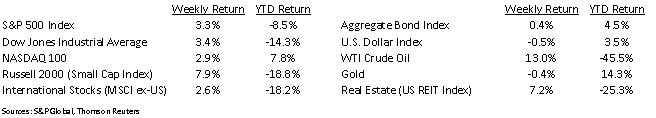

Financial Market Update

Dissecting Headline: Monetary Policy and Fiscal Policy

The Federal Reserve manages its part of the economy via Monetary Policy. This includes setting short-term interest rates and controlling the supply of money, or liquidity, in the economy. When COVID began impacting the economy, the Fed reduced interest rates and began purchasing bonds. The second action, purchasing bonds, creates liquidity by putting money into the economy when purchasing the bonds. The Fed can act swiftly since it is independent and requires no drawn-out negotiations.

The Administration (with Sec Mnuchin as Treasury Secretary) and Congress engage in Fiscal Policy. This includes tax and spending policy. The CARES Act and other COVID spending measures direct money to individuals, businesses, and other recipients to have an impact on economic stability and growth. The money spent through the CARES Act was not on hand via taxes, so the government needs to issue bonds to fund these programs. The Federal Reserve, by purchasing bonds, helps create the liquidity required to support Fiscal Policy.

Chairman Powell’s comments this week can be summarized as the Fed is able to support liquidity but the Administration and Congress may need to authorize more spending to help further support the economy. The Fed can employ Monetary Policy but requires the Administration, Senate and House of Representatives to work together on Fiscal Policy.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint May 25, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.