Corporate earnings led the market again last week. Of the 117 companies in the S&P 500 Index that have reported earnings for the quarter, 83.8% have reported earnings above consensus estimates. The S&P 500 was +1.7%, the Dow was +1.1% and the NASDAQ was +1.4%. Oil continued its multi-week rally, +1.8%. The U.S. 10-year Treasury bond yield increased to 1.638% at Friday’s close versus 1.574% the previous week.

Current forecast for the S&P 500 Index is for earnings to be +34.8% y/y versus an expectation of +32.0% last week. This week 165 companies in the S&P 500 are scheduled to report earnings. Continued container port and logistics congestion and the impacts of inflation were called out across multiple industries during quarterly earnings reports. One common theme was companies paying expedited freight costs to fill customer orders.

Initial unemployment claims for the week of October 16th decreased to 290,000 versus the previous week at 296,000. Continuing claims for October 9th were 2.481 million versus 2.603 million the week prior. While there are still dislocations in the labor market, the Federal Reserve has indicated that the further substantial progress in the labor market to begin tapering its monthly bond purchases has largely been achieved. Tapering of bond purchases likely begins in November.

In our Dissecting Headlines section, we look at Disinflation.

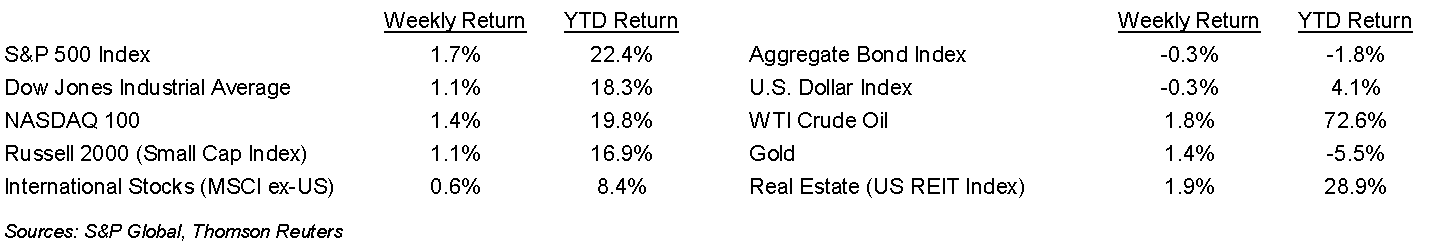

Financial Market Update

Dissecting Headlines: Disinflation

The recent increase in the rate of inflation has caused consumers to worry over how high some prices can go. What has been problematic is not inflation in general, but the acceleration in the rate of inflation. What would calm consumers and investors is not deflation, but disinflation. While deflation is the price of goods going down, thus making it the opposite of inflation, broad deflation occurs very rarely across the economy. When broad deflation does occur, it is typically a bad signal for economic growth. Disinflation, or a reduction in the rate of inflation, is a more typical outcome and can be a healthy signal for the economy.

While some prices can fall on a secular basis because of innovation (think flat screen televisions) or fall during short term reduction in demand (think gasoline during COVID), a growing economy with growing wages typically sees a modest level of overall inflation. This is the 2% target rate that the Federal Reserve discusses. Deflation or extremely low inflation can be a signal of low economic growth, which often results in the Central Bank stimulating demand through lower interest rates and higher liquidity. With the Federal Reserve currently looking to reduce the level of accommodative monetary policy put in place at the outset of the COVID-19 pandemic, it is working to reign in the accelerating levels of inflation back toward its 2% target, or create an environment of disinflation until the target is reached.

A period of disinflation is likely to be met with better stability in the labor market, since wages are not rising as quickly and better stability in consumer spending as prices are not rising as rapidly. This is the scenario where the Federal Reserve is trying to cool down the economy and create price stability without being too aggressive and pushing the economy into a recession. This should play out over the course of 2022 and 2023.

________________________________________

Want a printable version of this report? Click here: NovaPoint October 25, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.