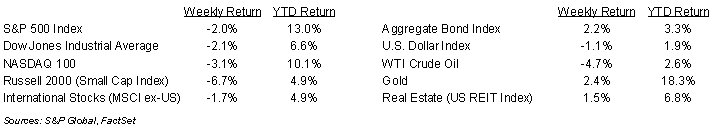

Equity markets retreated last week on concerns that rate cuts may come too late to keep the economy from slipping. For the week, the S&P 500 was -2.0%, the Dow was -2.1%, and the NASDAQ was -3.1%. Within the S&P 500 Index, the Utilities, Real Estate, and Communication Services sectors led the market, while the Consumer Discretionary, Technology, and Energy sectors lagged. The 10-year U.S. Treasury note yield decreased to 3.796% at Friday’s close versus 4.196% the previous week.

The Federal Reserve held short-term interest rates steady at the conclusion of the Federal Open Market Committee (FOMC) meeting last Wednesday. Friday’s Employment Situation Report showed growth of only 114,000 jobs versus expectations for 185,00 and the unemployment rate rising to 4.3% . Following the FOMC meeting, Fed Chair Jerome Powell said, “a reduction in our policy rate could be on the table as soon as the next meeting in September.” With the next FOMC meeting not scheduled until September 17th-18th, investors may now be concerned this may be too late to help the economy. CME Fed funds futures currently imply a total of 1.25% in rate cuts between now and year-end starting with a 0.50% cut at the September meeting.

We are 75% complete with second quarter earnings reports. Another 79 companies in the S&P 500 Index are scheduled to report earnings this week. For the second quarter, earnings growth is expected be 11.5% higher year-over-year with revenue growth of 5.3%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 10.8% with revenue growth of 5.1%.

In our Dissecting Headlines section, we look at the current market decline.

Financial Market Update

Dissecting Headlines: Shakeout

The major stock market averages are higher year-to-date. However, since the start of the third quarter, the NASDAQ 100 Index has declined 6.3% and the S&P 500 Index has declined 2.0%. While an economic or geopolitical catalyst can often be the cause of a decline as investors become risk averse during the uncertainty caused by the event, there are also times when the markets get too exuberant and a temporary decline in stock prices is warranted.

On average, a decline of 5% can occur three or four times a year. A decline of 10%, often referred to as a correction, has happened about once every year to year-and-a-half. The recent closing high level for the S&P 500 Index was on July 16th and the index has declined 5.7% since that level. The recent closing high for the NASDAQ 100 Index was on July 10th and the index has declined 10.8% since that level. The Dow Jones Industrial Average, which still remains the laggard for the year among the three averages, is down 3.5% from its recent high on July 17th.

As mentioned above, risk to the timing of interest rate reductions by the Federal Reserve versus the performance of the economy seems to be the cause of the current pullback. It looks all but certain the Fed will lower interest rates at the September meeting. The six weeks between now and then could test some investors’ patience and create opportunities for others.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly August 5, 2024

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.