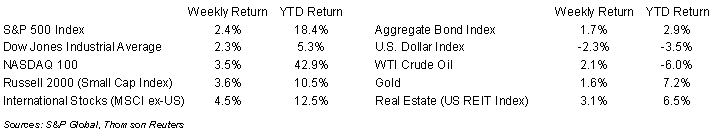

A slowing in the rate of inflation and a good start to the earnings reporting season boosted stocks last week. The weekly return for the S&P 500 Index was +2.4%, the Dow was +2.3%, and the NASDAQ was +3.5%. The 10-year U.S. Treasury note yield decreased to 3.820% at Friday’s close versus 4.048% the previous week.

The June Consumer Price Index (CPI) was +0.2% month-to-month and core CPI, which excludes food and energy, was +0.2% month-to-month. Year-over-year, CPI was +3.0% and core CPI was +4.8%. This gave investors confidence inflation was coming under control and the Fed would be nearing the end of its tightening cycle. Multiple Fed officials have commented that two 0.25% increases in the Fed funds rate would be adequate for the remainder of the year. Current probability for a 0.25% increase in the Fed funds rate at the July 26th Federal Open Market Committee meeting is 96.1% versus 93.0% a week ago.

Earnings reporting continues to ramp up this week with 68 companies in the S&P 500 Index scheduled to report earnings. Of the 30 companies in the S&P 500 that have reported earnings, 80.0% have reported earnings above analyst estimates. This compares to a long-term average of 66.4% and prior four quarter average of 73.4%. Second quarter earnings expectations for the S&P 500 Index is an 8.1% year-over-year earnings decline on a revenue decline of 0.9%. Current expectations for full year 2023 earnings are an increase of 0.3% on revenue growth of 1.6%.

In our Dissecting Headlines section, we look at the impact of the Taylor Swift tour and Hollywood strike on the U.S. economy.

Financial Market Update

Dissecting Headlines: Taylor, Hollywood, and the Economy

The entertainment industry and economy are experiencing two distinct events. The positive is the impact of the Taylor Swift concert tour on each city it visits. The negative is the impact of the Hollywood writers and performers strike.

According to the Common Sense Institute, Taylor Swift’s U.S. tour could generate $4.6 billion in total consumer spending which is larger than the GDP of 35 countries. Beyond tickets and merchandise sales, the tour has impacted the hotel and restaurant revenue in cities that have hosted the singer. The Federal Reserve’s Beige Book even mentioned the singer last week in its regional commentary from the Federal Reserve Bank of Philadelphia. “Despite the slowing recovery in tourism in the region overall, one contact highlighted that May was the strongest month for hotel revenue in Philadelphia since the onset of the pandemic, in large part due to an influx of guests for the Taylor Swift concerts in the city.”

On the flip side, the current Hollywood strike could see a greater than $3 billion negative impact to the economy. The strike of both the Writers Guild and Screen Actors Guild is happening concurrently for the first time in 63 years. The 100-day strike in 2007 of only the writers had an estimated $2.1 billion negative impact.

The key issues in the strike include the impact of Artificial Intelligence (AI) and residual pay for streaming. These two tech industry disruptions are hitting home in an industry that had previously welcomed tech innovations such as Computer Generated Imagery (CGI) to make the onscreen experience more impactful.

The Taylor Swift impact goes beyond concert tickets and helps the hospitality, transportation, and other related industries, while the Hollywood strike puts film and television support staff out of work to include carpenters, caterers, hair/makeup/wardrobe workers, and other supporting industries.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly July 17, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.