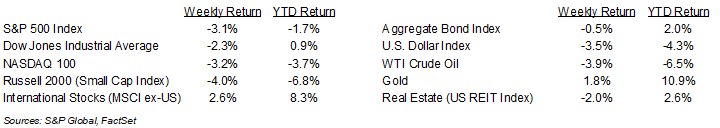

Uncertainty caused by new policies such as lower government spending and tariffs to shape trade has weighed on the equity markets. For the week, the S&P 500 Index was -3.1%, the Dow Jones Industrials -2.3%, and the NASDAQ -3.2%. All sectors in the S&P 500 Index were lower for the week with the smallest declines seen in the Real Estate, Health Care, and Consumer Staples sectors, while the Financial, Energy, and Consumer Discretionary sectors had the largest declines. The 10-year U.S. Treasury note yield increased to 4.315% at Friday’s close versus 4.197% the previous week.

The February Employment Situation report showed 151,000 net new jobs created versus an expectation of 159,000. The unemployment rate rose to 4.1% from 4.0% in January. Federal Reserve Chairman Jerome Powell said Friday that the U.S. economy was steady, but that the implementation of new policies by the Trump administration was causing uncertainty among both households and businesses. As of now, the Fed looks to be on hold at its March and May meetings, but CME Fed funds futures are showing 0.25% reductions at both the June and July meetings. We should get further insight to the Fed’s outlook when the updated Summary of Economic Projections is published at the March 19th meeting. Both fiscal and monetary policy should become clearer once Congress passes a budget in late March or early April.

We are in the crossover of the quarterly earnings periods with three companies in the S&P 500 Index reporting fourth quarter earnings and the first two companies reporting first quarter earnings. Fourth quarter earnings should end up 18.3% higher year-over-year with 5.3% revenue growth. First quarter 2025 earnings growth is currently forecast at 7.3% year-over-year with 4.3% revenue growth. Full-year 2025 earnings are expected to grow by 11.6% with revenue growth of 5.4%.

In our Dissecting Headlines section, we show why demand for rare earth and other critical minerals is shaping economic and diplomatic policy.

Financial Market Update

Dissecting Headlines: Rare Earth and Critical Minerals

Whether China, Ukraine, or even Greenland, there is discussion of what the U.S. government and U.S. companies can do to secure a larger and more stable supply of rare earth and other critical minerals.

The demand for rare earth minerals is growing exponentially, driven by several high-tech end-markets to include electric vehicles and high-performance magnets used in EV motors, renewable energy which needs several rare earth minerals for wind turbines and solar panels, and defense and technology where the military uses rare earths for advanced weapons systems, radar, missiles, drones, fighter jets, and communications equipment. Rare earth minerals are a 17 mineral subset of the list of critical minerals and include Neodymium for high performance magnets for electric vehicles, wind turbines, and medical imaging, Dysprosium which enhances heat resistance for electric vehicle and military applications, Terbium used for display technology, and Yttrium used for lasers, superconductors, and aerospace ceramics.

While reserves of rare earth elements are held in multiple countries to include China (38.1%), Vietnam (19.1%), Brazil (18.2%), and Russia (8.7%), the current production is primarily concentrated in China with 67.9%. The United States is estimated to have approximately 2.0% of the global reserves and currently has 12.2% of global production.

In addition to the rare earth minerals, several critical minerals such as Lithium, Cobalt, Nickel and Graphite are also needed to advance the use of major technology, energy, and military end-market applications.

These rare earth and critical minerals are behind the urgency of both economic and diplomatic efforts of the Trump administration to secure consistent supply of minerals to power both U.S. economic and U.S. military leadership.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly March 10, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.