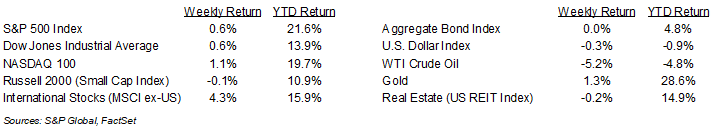

Stocks kept up their post-Fed meeting momentum last week. For the week, the S&P 500 was +0.6%, the Dow was +0.6%, and the NASDAQ was +1.1%. Within the S&P 500 Index, the Materials, Consumer Discretionary, and Industrial sectors led the market. The Health Care, Energy, and Financial sectors lagged. The 10-year U.S. Treasury note yield increased to 3.748% at Friday’s close versus 3.734% the previous week.

The August Personal Consumption Expenditures (PCE) Prices were +0.1% month-over-month and +2.2% year-over-year. Excluding food and energy prices, PCE was +0.1% month-over-month and +2.7% year-over-year. This was sufficient to show progress toward the Fed’s 2% inflation target. The key economic data for this week is the September Employment Situation Report scheduled for Friday. CME fed funds futures currently favor a 0.25% rate reduction at the November Federal Open Market Committee (FOMC) meeting. One additional item to watch is the potential for a port worker strike covering 36 ports along the East Coast and Gulf of Mexico.

The third quarter ends today and the third quarter earnings reporting period begins next week. Third quarter earnings growth is currently forecast at 4.6% year-over-year with revenue growth of 4.8%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 10.0% with revenue growth of 5.1%.

In our Dissecting Headlines section, we look at the sector-level expectations for third quarter earnings.

Financial Market Update

Dissecting Headlines: Third Quarter Earnings

The third quarter earnings reporting season begins next week. Earnings growth for the S&P 500 Index is currently forecast at +4.6% year-over-year with revenue growth of +4.8%. This would be the fifth consecutive quarter of year-over-year earnings growth.

Within the sectors of the S&P 500, the highest earnings growth should be in the Technology sector at +15.6% year-over-year, followed by the Health Care sector at +11.2%, Communication Services at +10.4%, Real Estate at +5.1%, Utilities at +4.1%, Industrials at +1.6%, Consumer Staples at +0.5%, and Financials at +0.1%. Three sectors are expected to see a year-over-year decline in earnings with the Energy sector at –18.3% year-over-year, Materials at –1.9%, and Consumer Discretionary at –0.3%.

Semiconductors remain the growth engine of the Technology sector given demand for AI and other applications. The steep decline in the Energy sector is being driven by lower prices.

Issues we may hear on earnings conference calls are likely to range from the potential of a soft landing based on the current rate reduction cycle versus impacts of inflation and labor market strength, to how companies are integrating AI tools and services into their businesses, to the health of the consumer heading into the holiday shopping season.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly September 30, 2024

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.