The early part of the week saw stocks under pressure from inflation concerns. A rally on Thursday and Friday triggered by the easing of mask wearing guidelines by the Center for Disease Control recouped some of the losses.

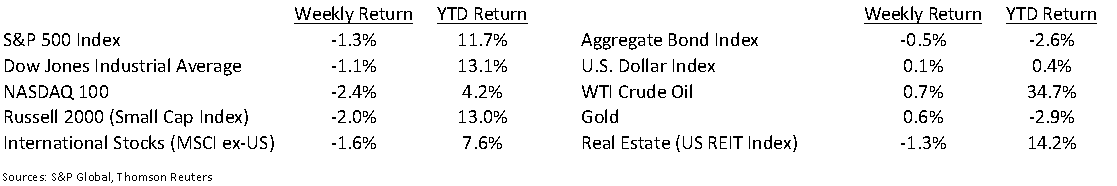

The Dow Jones Industrial Average closed the week –1.1%, the S&P 500 Index was –1.3%, and the NASDAQ 100 Index was –2.4%. The U.S. 10-year Treasury bond yield rose to 1.635% at Friday’s close versus 1.579% the previous week.

Several large retail companies report this week to close out the first quarter earnings season. Of the 457 companies in the S&P 500 Index that have reported earnings to date, 87.1% have reported earnings above analyst estimates. This week another 19 companies in the S&P 500 Index are scheduled to report earnings. First quarter earnings are expected to grow 50.6% year-over-year, an increase from last week’s expectation of 50.4% growth and 25.0% at the start of the quarterly reporting. Full-year 2021 earnings are expected to grow 35.1% year-over-year versus expectations of 34.7% growth last week and 26.5% at the start of the quarterly reporting.

Initial unemployment claims for the week of May 8th decreased to 473,000 versus the previous week at 507,000. Continuing claims for May 1st were 3.655 million versus 3.700 million the week prior.

The Consumer Price Index showed retail prices +4.2% higher over the past 12-months and the Producer Price Index showed wholesale prices +4.6% higher. We take a look at the current inflationary pressures in our Dissecting Headlines section.

Financial Market Update

Dissecting Headlines: Inflation Watch

The April Consumer Price Index (CPI) and Producer Price Index (PPI) showed signs of an uptick in inflation. There are several reasons for the increase. First, prices naturally rise over time in a growing economy. In the recovery from the COVID-driven recession, prices have increased. Second, various industries that shutdown production and furloughed workers during COVID have yet to increase production to meet a resurgence in demand as the economy has reopened. Third, some industries have acute shortages. The current shortage of semiconductors has limited automobile production causing used car prices to increase 21% year-over-year. Fourth, the current measurement period for year-over-year comparisons is from the depth of the pandemic. Gasoline prices are 49% higher year-over-year because they are comparing versus the drastic falloff in demand during COVID. Fifth, the government in an attempt to stimulate the economy has been pushing out trillions of dollars. Most of this has occurred while there was little outlet for the spending due to travel and business restrictions in most of the country.

Some of the inflationary pressures, such as energy and automobile prices, are likely transitory. Others, such as commercial transportation expenses and commodity prices, are likely persistent until an adequate supply response evolves or demand becomes satiated. Inflation is also measured in rate-of-change, either year-over-year or month-over-month changes in prices, so as we distance ourselves from the recession and the pandemic, the rates of change are likely to normalize.

The Federal Reserve has kept short-term interest rates low to make sure the economy can fully recover from the pandemic. The economy is currently running above the Fed’s targeted inflation rate of 2%. If the inflation turns out to be transitory, they will likely remain patient. If it persists, they may need to adjust their stance on monetary policy.

________________________________________

Want a printable version of this report? Click here: NovaPoint May 17, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.