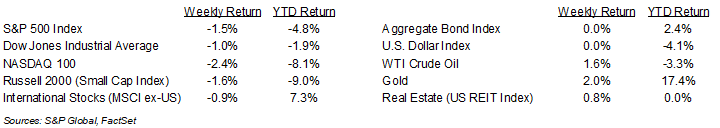

Fear trumped greed to lead equity markets lower last week, mainly from concern over the economic impact of pending tariffs. For the week, the S&P 500 Index was -1.5%, the Dow Jones Industrials -1.0%, and the NASDAQ -2.4%. The S&P 500 Index was led by the Consumer Staples, Energy, and Real Estate sectors, while the Information Technology, Communication Services, and Industrial sectors lagged. The 10-year U.S. Treasury note yield increased to 4.259% at Friday’s close versus 4.250% the previous week.

Automobile tariffs were announced for implementation on April 3rd and the long-awaited reciprocal tariffs on countries that have active tariffs on U.S. produced goods are scheduled to be announced on April 2nd. Trade negotiations are likely to continue, country-by-country, so the economic impact and duration of tariffs are unknown. The tariff overhang has been a signific factor impacting investor sentiment for the past several weeks.

In other economic headlines, inflation remains sticky with February Personal Consumption Expenditures (PCE) Prices +0.3% month-over-month and core PCE prices, which exclude the impact of food and energy prices, +0.4% month-over-month. Year-over-year PCE prices were +2.5% and core prices were +2.8%. This week’s calendar brings the March Employment Situation report scheduled for Friday. Current CME Fed funds futures indicate there could be up to 0.75% in reductions to the Fed funds rate by December.

Three companies in the S&P 500 Index are scheduled to report first quarter earnings this week. First quarter 2025 earnings growth is currently forecast at 7.3% year-over-year with 4.2% revenue growth. Full-year 2025 earnings are expected to grow by 11.5% with revenue growth of 5.4%.

In our Dissecting Headlines section, we look news on tariffs.

Financial Market Update

Dissecting Headlines: Everything Everywhere All at Once

The Trump administration announced a 25% tariff on all automobile imports effective April 3rd and select auto parts effective May 3rd. The move is designed to increase preference for U.S. made cars and encourage more U.S. auto production. Some U.S. flagged companies make a percentage of their cars outside of the U.S. and import them and some foreign flagged automakers make cars in the U.S., so the impact per manufacturer is varied.

Based on data from Wards Auto, electrical vehicle makers Rivian and Tesla make all their U.S. sold cars domestically. This is followed by Ford at 78%, Honda at 64%, Stellantis at 57%, Subaru at 56%, Nissan at 53%, and General Motors at 52%. Other foreign manufacturers also make a reasonably high amount of cars in the U.S. with Toyota and BMW at 48% each, Mercedes at 43%, and Hyundai-Kia at 33%. Not all content in the vehicles is 100% sourced from the U.S. so the parts tariff will have impact beyond final assembly numbers.

Beyond the previously announced automobile, steel, aluminum tariffs, and tariffs announced on Canada, Mexico, and China, April 2nd is the day scheduled for the announcement of reciprocal tariffs equal to the existing tariffs that other countries have on U.S. imports. The specifics of the program are unknown, and target counties include the European Union, Brazil, South Korea, India, and others.

This large range of potential outcomes has become an overhang to the financial markets and investor sentiment over the past few weeks. Better clarity, expected this week could help better calibrate the economic impact. President Trump said he is open to carving out deals with countries seeking to avoid U.S. tariffs, but those agreements would have to be negotiated after his administration announces reciprocal tariffs on April 2nd. Some successful negotiations with one or more nations could also help soothe investor concerns that there is an avenue to reduce the impending standoff in global trade.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly March 31, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.