The S&P 500 Index snapped a three-week decline on optimism the U.S. and China were making progress on the trade dispute. In an announcement on Friday, the U.S. agreed not to enact the scheduled October 15th tariff increases on $250 billion of goods in exchange for China agreeing to purchase more U.S. agricultural products. What was called “Phase 1” of progress in the trade negotiations failed to address some of the core issues in the dispute to include protection of intellectual capital of U.S. firms operating in China. Given the erratic nature of the trade negotiations, more progress likely needs to be seen to give U.S. companies and investors the confidence to make plans and deploy investment capital in a post-trade dispute environment, but the current orientation is one of optimism.

Aside from the potential progress on trade, there were a few other issues providing optimism after a three-week market decline. The yield curve reverted back closer to its traditional shape versus the inverted shape that caused concerns about a recession earlier in the year. The Consumer Price Index and Producer Price Index reports for September also showed that inflation remains under control.

Barring a major trade or other geopolitical announcement, investors will switch focus to corporate earnings this week with 52 companies in the S&P 500 scheduled to report. Of the 23 that have already reported third quarter earnings, 91% have exceeded expectations, 4% have met expectations and 4% have reported below expectations. Current expectation is for a 3.2% decline in year/year earnings on 3.5% revenue growth versus last week’s consensus of a 2.7% earnings decline on a 3.6% increase in revenue. The Energy sector is expected to report the worst year/year changes in earnings and we explain some factors impacting the Energy sector in our Dissecting Headlines section below.

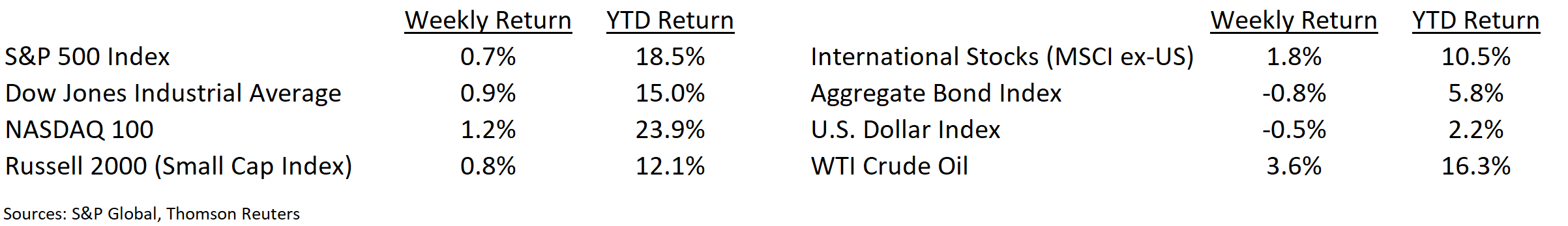

Financial Market Update

Dissecting Headlines: The Energy Sector

As mentioned above, the current third quarter earnings expectation for S&P 500 companies is for a 3.2% decline in year/year earnings on 3.5% revenue growth. Excluding the Energy sector, the consensus expectation for S&P 500 earnings is for a 1.0% decline in year/year earnings on a 4.6% increase in revenue. The Energy sector represents 4.5% of the S&P 500 Index and earnings for energy companies are expected to decline 34.3% year/year on a revenue decline of 6.1%.

What is the S&P Energy sector and what’s going on? The S&P Energy sector consists of 28 companies engaged in the exploration, production, transportation, and distribution of crude oil, natural gas, and transportation fuels. Earnings for the sector can be volatile since the price of crude oil and natural gas impact the dollar volume of sales. The average price for a barrel of crude oil during the third quarter of 2019 was $56.44 versus an average of $69.43 during the third quarter of 2018 (-18.7%). Natural gas prices averaged $2.326 per million BTUs (British Thermal Units) in the third quarter of 2019 versus $2.865 in the third quarter of 2018 (-18.8%). There are other puts and takes such as volumes, operating efficiencies, financing costs, and changes in capital structure, but, in general, when companies sell a similar volume of goods at a lower price, they lose operating leverage and the earnings impact can be greater than the revenue impact.

NovaPoint Capital owns S&P Energy sector constituents Exxon Mobil, Chevron, and EOG Resources in its NovaPoint Dividend Growth Strategy.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint October 14, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.