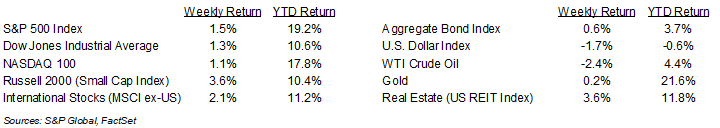

The equity market finished higher on the week as Fed Chair Jerome Powell said the time has come for monetary policy to adjust. For the week, the S&P 500 was +1.5%, the Dow was +1.3%, and the NASDAQ was +1.1%. Within the S&P 500 Index, the Real Estate, Materials, and Consumer Discretionary sectors led the market, while the Energy, Technology, and Communication Services sectors lagged. The 10-year U.S. Treasury note yield decreased to 3.804% at Friday’s close versus 3.888% the previous week.

The Fed Chairman outlined his view that monetary policy would loosen and short-term interest rates would start to decline. He stated that while inflation is still above the Fed’s policy target of 2% that it was on a sustainable path to get there. Based on CME Fed funds futures, investors currently see a 0.25% reduction to the Fed funds target rate to a 5.00% to 5.25% range at the September FOMC meeting and a total of 1.00% in cumulative reductions by year-end.

We are 96% done with second quarter earnings reports. Fifteen companies in the S&P 500 Index are scheduled to report earnings this week. For the second quarter, earnings growth is expected be 10.9% higher year-over-year with revenue growth of 5.2%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 10.1% with revenue growth of 5.1%.

In our Dissecting Headlines section, we look at a few end of Summer data points to include Labor Day travel and back-to-school shopping.

Financial Market Update

Dissecting Headlines: Farewell Summer

Labor Day weekend is on the horizon, marking the traditional end of the Summer season. Despite several years of above-average inflation and dwindling pandemic-era savings, American consumers are still hanging tough, but have grown a bit more cautious.

The National Retail Federation is forecasting back-to-school spending of $38.8 billion, the second highest on record, but down 6.5% from 2023’s record $41.5 billion in spending. Part of the lower spending is a decrease in prices for many common back-to-school purchases with several essential supplies such as paper, pencils, crayons, and sticky notes all down more than 10% year-over-year. Backpacks, however, are more expensive year-over-year. Data from other surveys indicate that over 30% of parents say that they expect to take on debt to cover their back-to-school shopping needs.

While back-to-school shopping is posing some challenges, Labor Day weekend travel is expected to increase 9% year-over-year, based on data from the American Automobile Association (AAA). Similar to back-to-school, travel prices have come down with the overall cost to travel domestically lower by 2% year-over-year. One big contributor to lover travel costs is gasoline prices. The national average price for regular unleaded is $3.351 per gallon, which is 12.3% lower than a year ago.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly August 26, 2024

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.