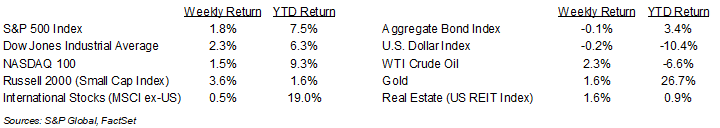

An upbeat employment report led stocks to new highs in front of the holiday weekend. For the week, the S&P 500 Index was +1.8%, the Dow Jones Industrials +2.3%, and the NASDAQ +1.5%. The Materials, Financials, and Technology sectors led the S&P 500 Index for the week, while the Communication Services, Utilities, and Consumer Discretionary sectors lagged. The 10-year U.S. Treasury note yield increased to 4.340% at Friday’s close versus 4.284% the previous week.

The June Employment Situation report showed 147,000 net new jobs created versus an expectation of 120,000. The June unemployment rate declined to 4.1% versus 4.2% in May. The upside data in the Employment report lowered the probabilities for CME Fed funds futures to two 0.25% reductions in the Fed funds rate over the balance of the year from three the week prior.

The July 9th trade negotiation deadline comes this week. Negotiations with multiple countries are ongoing, but those that don’t strike a trade deal with the U.S. could see higher tariffs going to effect on August 1st. These situations remain fluid, and we are likely to see trade and tariffs occupy headlines this week.

The second quarter earnings reporting period begins this month. Current expectation for the S&P 500 Index is earnings grow at 5.0% year-over-year with revenue growth of 4.2%. Full-year 2025 earnings are expected to grow by 9.1% with revenue growth of 5.0%.

In our Dissecting Headlines section, we look at highlights of the One, Big, Beautiful Bill.

Financial Market Update

Dissecting Headlines: One, Big, Beautiful Bill

The U.S. Congress passed its budget reconciliation bill, also known as the One, Big, Beautiful Bill. The bill contains provisions for a permanent extension to the 2017 Tax Cuts and Jobs Act, funding for defense and border security, and stricter eligibility and work mandates for some government programs.

The 2017 Tax Cuts and Jobs Act was set to expire at the end of 2025. This would have reverted income tax rates to the higher pre-2018 levels, lowered the standard deduction, and ended the pass-through business deduction. In addition to the extension, additional provisions were made for not taxing tips or overtime, increasing the state and local tax (SALT) deduction, and additional deductions for senior citizens, auto loan interest and tax-deferred savings for children.

The bill adds a $150 billion supplement for defense in FY26, bringing total defense spending to around $1 trillion, and $150 to $170 billion for immigration enforcement and border security. Lower government spending is in Medicaid and the SNAP food aid program by tightening eligibility and establishing work mandates.

In terms of industry impact, there is a phase out planned for tax credits to wind, solar, electric vehicle, and charging infrastructure; regulatory benefits to fossil fuels to include streamlining permitting for energy projects; and benefits to agriculture with biofuel credits and expanded crop insurance.

While there was much debate over the bill, the legislation is now in effect and removes some uncertainty for investors.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly July 7, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.