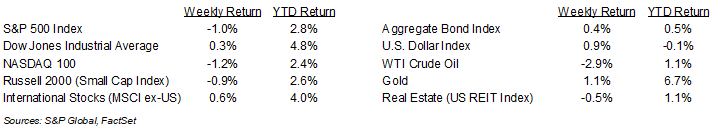

Concerns about Chinese AI competition, a Federal Reserve policy meeting, a mix of earnings reports, and news on tariffs led to a volatile week. For the week, the S&P 500 Index was -1.0%, the Dow Jones Industrials +0.3%, and the NASDAQ -1.2%. The S&P 500 Index was led by the Communication Services, Consumer Staples, and Health Care sectors, while the Technology, Energy, Utility sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.546% at Friday’s close versus 4.621% the previous week.

Chinese AI competitor DeepSeek rattled markets last Monday by introducing an AI model it claimed was developed cheaper and with less powerful processing. While there is much skepticism, especially on the cost claim, it did highlight the economic “space race” between the U.S. and China that has been underway in AI and other technologies.

The Federal Reserve held rates steady at its policy meeting. They cited a healthy labor market, elevated inflation, and need to see the economic impact of the new administration’s policies for its decision. Based on CME Fed funds futures, the Fed is seen on hold until its June meeting.

President Trump will impose 25% tariffs on Canada and Mexico, and 10% tariff on China beginning February 4th. The reasons cited for the tariffs include immigration, trade deficits, and fentanyl. Retaliatory actions from Canada and Mexico are underway and China is raising the matter to the World Trade Organization.

Outside of news on tariffs, the key economic data point this week should be the January Employment Situation Report scheduled for Friday.

The fourth quarter earnings reporting period peaks this week with 131 companies in the S&P 500 Index scheduled to report earnings. Fourth quarter earnings growth is currently forecast at 13.2% year-over-year with revenue growth of 5.0%. Full-year 2024 earnings for the S&P 500 Index are expected to grow by 9.4% with revenue growth of 5.1%. Full-year 2025 earnings are expected to grow by 14.3% with revenue growth of 5.7%.

In our Dissecting Headlines section, we look at the current tariff issues.

Financial Market Update

Dissecting Headlines: Tariffs

Using tariffs to level the playing field for U.S. trade and cooperation on issues such as illegal immigration and the fentanyl crisis was a major talking point during President Trump’s campaign. The tariffs are an economic tool that are likely being used here for negotiating leverage.

Canada and Mexico are extremely reliant on the United States as an export market. Nearly 80% of the exports of both countries go to the United States whereas the two countries only account for 33% of U.S. exports (approx. 17% Canada and 16% Mexico). A 25% tariff is enough to cause significant economic stress to both countries, so we don’t see this as a prolonged trade war.

The 10% tariff on China is a more measured move and likely designed to open a round of trade negotiations without fueling a significant trade war. The Chinese case is more complex given the growing economic and military rivalry.

Both situations are highly fluid currently and we are likely to initially see a high degree of dialogue between the U.S., Canada and Mexico to abate the situation.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly February 3, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.