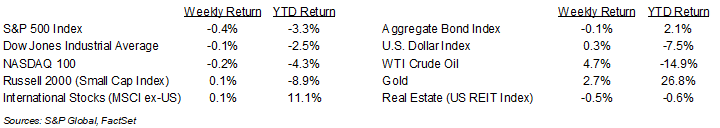

An initial trade deal with the United Kingdom and an uneventful Federal Reserve meeting held markets to a small decline last week after back to-back positive weeks. For the week, the S&P 500 Index was -0.4%, the Dow Jones Industrials -0.1%, and the NASDAQ -0.2%. The S&P 500 Index was led by the Industrial, Consumer Discretionary, and Utilities sectors, while the Health Care, Communication Services, and Consumer Staples sectors lagged. The 10-year U.S. Treasury note yield increased to 4.369% at Friday’s close versus 4.308% the previous week.

Announcement of an initial trade deal with the U.K. has opened the door for trade deals with other countries as momentum builds in negotiations. The 90-day drop in tariffs with China announced over the weekend should further build on this momentum.

The Federal Reserve held the Fed funds target rate at 4.25% to 4.50%. The Federal Open Market Committee (FOMC) continues to take a wait-and-see approach to economic data as the impact of current tariff and trade actions has yet to show in any meaningful way. The Fed will likely need to take a stand on its outlook by the June 18th FOMC meeting when an update to the Summary of Economic Projections is due. The March outlook showed a total of 0.50% in reductions to the Fed funds target rate was appropriate. After the tariff and trade news with the UK and China, this is inline with the current CME Fed funds futures for the year. This week’s reports on inflation with the Consumer Price Index (CPI) and Producer Price Index (PPI) may show impact from initial tariff implementations.

We are on the downslope of the first quarter earnings season. This week 12 companies in the S&P 500 Index scheduled to report earnings results. First quarter 2025 earnings growth is currently forecast at 13.4% year-over-year with 4.8% revenue growth. Full-year 2025 earnings are expected to grow by 9.3% with revenue growth of 4.9%.

In our Dissecting Headlines section, we provide details of the UK and China trade agreements.

Financial Market Update

Dissecting Headlines: UK and China Trade

Progress on tariff and trade policy saw some initial movement with a trade agreement with the U.K. The U.K. is the U.S.’s 7th largest trading partner.

As part of the agreement, the U.K. gets a reduced tariff from 27.5% to 10% on up to 100,000 U.K.-made cars annually, tariffs on British steel and aluminum are eliminated with a tariff-free quota of 13,000 tons granted to U.K. producers, tariffs are removed on British aerospace parts, including Rolls-Royce engines, and there is a tariff-free quota of 13,000 tons for U.K. beef export to the U.S.

The U.S. gets the 19% tariff on U.S. ethanol exports to the U.K. eliminated and a removal of tariffs on U.S. beef. The U.K. will reduce its average tariff on U.S. goods from 5.1% to 1.8%, covering more than 2,500 American-made products. The agreement also benefits U.S. companies in the U.K.’s procurement market and streamlines customs procedures.

The U.S. and China agreed to a 90-day pause on their recently escalated tariffs. China is the U.S.’s 3rd largest trading partner. The U.S. agreed to cut China tariffs to 30% from 145%. The 30% was expressed as 20% fentanyl tariffs plus 10% reciprocal tariffs. China agreed to cut retaliatory tariffs from 125% to 10%. These new rates take effect Wednesday. Both sides will continue discussions during the 90-day period.

These deals likely open the door for more countries to follow. Once multiple trade agreements are completed with the first few trading partners, other countries may feel compelled to participate rather than risk being shutout.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly May 12, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.