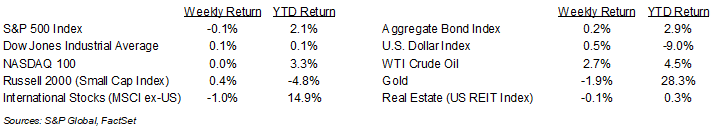

Markets closed flat following a week that included an update of economic projections from the Federal Reserve. For the week, the S&P 500 Index was -0.1%, the Dow Jones Industrials +0.1%, and the NASDAQ was flat. The Energy, Technology, and Financial sectors led the S&P 500 Index for the week, while the Health Care, Communication Services, and Materials sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.380% at Friday’s close versus 4.410% the previous week.

The Federal Reserve held the Fed funds rate steady at its June policy meeting in the 4.25% to 4.50% target range. It also kept its policy path for 2025 consistent with its March projection for a 3.75% to 4.00% target range for year-end. Current CME Fed funds futures show 0.25% reductions in the Fed funds rate for both the September and December meetings. Key economic data for the coming week includes the May Personal Consumption Expenditures (PCE) Price Index scheduled for Friday.

With the U.S. strike on Iran, there is speculation that Iran could move to close the Strait of Hormuz, choking down oil exports from the region. As of early Monday morning, Crude Oil is only up about +1%, European markets are down slightly, and U.S. pre-markets are near flat. Investors appear to be taking a wait-and-see approach as more news is likely to unfold this week.

This week six companies in the S&P 500 Index are scheduled to report earnings. Second quarter earnings are expected to grow 4.9% with revenue growth of 4.1%. Full-year 2025 earnings are expected to grow by 9.0% with revenue growth of 5.0%.

In our Dissecting Headlines section, we look at the Federal Reserve’s updated economic projections.

Financial Market Update

Dissecting Headlines: Updated Economic Projections

At the conclusion of the Federal Open Market Committee (FOMC) meeting last week, the committee updated its economic projections for the remainder of 2025, as well as 2026 and beyond. The current set of projections is an update to its projections from the March meeting which occurred prior to the announcement of the “liberation day” tariffs.

For 2025, the FOMC sees Gross Domestic Product (GDP) growth at 1.4% vs. 1.7% previously, the unemployment rate at 4.5% vs. 4.4%, PCE inflation at 3.0% vs. 2.7%, and Core PCE inflation at 3.1% vs. 2.8%. It left the policy path consistent with its March projection of 3.75% to 4.00%, 0.50% lower than the current Fed funds range.

For 2026, the FOMC sees GDP growth at 1.6% vs. 1.8% previously, the unemployment rate at 4.5% vs. 4.3%, PCE inflation at 2.4% vs. 2.2%, and Core PCE inflation at 2.4% vs. 2.2%. It tightened its policy path to only a further 0.25%reduction in the Fed funds rate versus a 0.50% reduction previously.

Most FOMC members appear to be cautious on rate cuts because of the risk of tariffs causing inflation. One dissenting member of the FOMC is Fed Governor Christopher Waller who said late last week that the Fed should consider a July rate cut. He does not believe that tariffs are going to cause persistent inflation.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly June 23, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.