Thursday’s market decline was met with a rally on Friday. The S&P 500 has been positive eight out of the past 10 sessions. The S&P 500 Index closed the week +0.4%, the NASDAQ +0.7% and the Dow +0.3%. The U.S. 10-year Treasury bond yield decreased to 1.361% at Friday’s close versus 1.431% the previous week.

The second quarter earnings reporting season starts this week with many of the big banks reporting earnings. The current expectation is for S&P 500 earnings growth of 65.8% year over year. Cyclical sectors, especially those hit hard by COVID-19 a year ago, are poised to see the largest year-over-year earnings increases. Industrials, Consumer Discretionary, Energy, Materials, and Financials are all forecasted to see >100% earnings growth for the quarter.

In addition to the earnings reports, we get more data points on the state of inflation with the July Consumer Price Index (CPI) scheduled for Tuesday and the Producer Price Index (PPI) on Wednesday.

Initial unemployment claims for the week of July 3rd increased to 373,000 versus the previous week at 371,000. Continuing claims for June 26th were 3.339 million versus 3.484 million the week prior. Further progress on jobs may stay tentative until the fall when the remaining half of the states have the federal unemployment supplement expire.

In our Dissecting Headlines section, we take a closer look at the upcoming earnings reporting season.

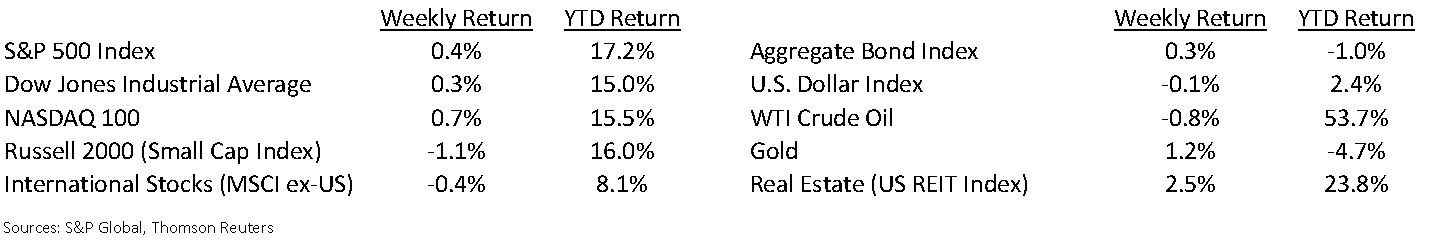

Financial Market Update

Dissecting Headlines: Second Quarter Earnings

It almost seems hard to remember this time a year ago. We were only a few months into the social and economic impact of the COVID-19 pandemic. In previewing corporate earnings for the second quarter of 2020, the expectation was initially for a decline of 43% with the U.S. economy (GDP) expected to decline 35%. The “U” shape of earnings in 2020 with the second and third quarters seeing the greatest decline has been met with the inverse this year as the U.S. exited the COVID-induced recession and travel and other consumer activities has started returning to normal.

As mentioned above, the current earning expectation for the second quarter is S&P 500 earnings growth of 65.8% year-over-year. Cyclical sectors, especially those hit hard by COVID-19 a year ago, are poised to see the largest year-over-year earnings increases. Industrials, Consumer Discretionary, Energy, Materials, and Financials are all forecasted to see >100% earnings growth for the quarter. Sectors that saw more stable growth in 2020 such as Information Technology, Healthcare, Communication Services, and Utilities are expected to see more moderate rates of growth in 2021.

Important commentary to listen for in company earnings reports and conference calls is how management teams are handling inflationary pressures in various material and service inputs and how they are handling issues with workers both in retaining workers who may decide to leave rather than return to the workplace as well as find new workers in a disjointed labor market.

________________________________________

Want a printable version of this report? Click here: NovaPoint July 12, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.