Earnings reports have been a positive surprise so far. For the S&P 500, 77 out of 500 companies have reported with 78% beating expectations, 5% matching and 17% below expectations. The 48 company earnings reports from the past week have raised the combined (reported and estimated) earnings growth for the quarter from -2.3% to -1.7%.

A complicated macroeconomic backdrop (flat yield curve, strong dollar, US-China trade issues) may have influenced analysts to the downside on their estimates for the quarter, but individual company actions (growth initiatives, cost control, share repurchase) have produced better than anticipated earnings results quarter-to-date.

Historical level of upside earnings surprises has averaged 3.2%. Quarter-to-date, upside earnings surprises are averaging 5.2%, meaning the average company is reporting earnings 5.2% higher than the consensus estimate of analysts. The best aggregate upside surprises have come in Communication Services (+20.3% with 2 of 20 companies reporting) and Materials (+14.0% with 1 of 25 reporting). Least aggregate surprises have come in Energy (+1.0% with 2 of 27 reporting) and Real Estate (+2.6% with 3 of 29 reporting).

Investors’ view of the market should continue to evolve as the remaining 400+ companies in the S&P 500 reporting earnings over the next few weeks.

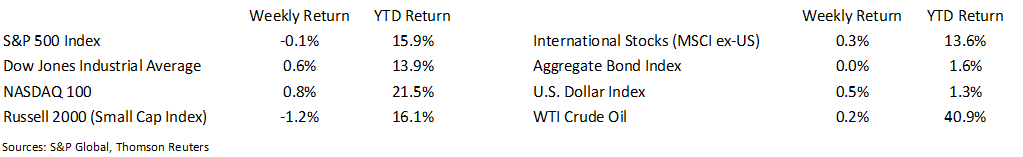

Financial Market Update

Dissecting Headlines: Relative Valuation

We discussed Price-to-Earnings Ratio (“PE ratio”) in last week’s commentary. The PE ratio is one metric that can be used in valuing stocks. The concept of “Buy Low, Sell High”, can be re-thought to “Buy Cheap, Sell Expensive”. One way to use PE ratios to determine cheap versus expensive is with relative valuation.

Relative valuation is comparing any metric, like the PE ratio, to determine if one stock is cheap or expensive compared to its own history, its peer group of stocks, or to the market as a whole. Because the stock market is always forward looking, investors tend to reward potential growth. Companies with higher growth rates tend to have higher PE ratios. Investors also tend to reward quality, so companies seen as providing a high degree of certainty to grow tend to have higher PE ratios.

Similar to home sales, your neighborhood “comps” are important. Investors would view stocks like Home Depot and Lowe’s in the same “neighborhood”. Similar with Coca-Cola and Pepsico, JPMorgan and Citigroup, etc. High potential, earlier stage companies may receive higher PE multiples like we see with some Technology companies, but those high PE ratios may be fragile if the companies don’t produce the expected earnings growth.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint April 22, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.