A combination of concern regarding a re-acceleration of COVID-19 cases and a natural tendency for a pause once the market regained its beginning year levels resulted in a decline in major market averages last week. The Federal Reserve which has pledged economic support throughout the COVID-19 crisis left short-term interest rates unchanged near zero at its meeting last week and indicated it plans to keep them near that level through 2022 to support an economic recovery.

The current consensus for second quarter S&P 500 earnings is for a year-over year decline of 42.9% on a 12.0% revenue decline. The bulk of the COVID related impact to the economy should be experienced in the second quarter and should mark a trough in both earnings and GDP decline in the U.S. Second quarter GDP is currently forecast to be down 35%. First quarter GDP fell 5.0%and the second quarter decline would confirm the economy as in a recession. Barring another COVID-like event, we should see incremental growth in the second half of 2020 and above-average growth in 2021.

Initial unemployment claims for the week of June 6th decreased to 1.542 million versus 1.897 million the week prior. The four-week moving average decreased to 2.002 million. Continuing Claims for May 30th were 20.929 versus 21.268 the week prior. The weekly new claims are being counterbalanced by new jobs created and furloughed workers returning to jobs. We view gains in employment to be a significant indicator of the health of the economy and a measure of a return to normal economic and social activity.

In our Dissecting Headlines section we look at the upcoming report on May Retail Sales.

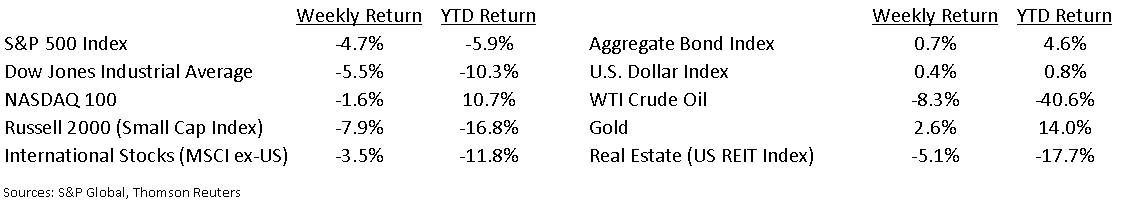

Financial Market Update

Dissecting Headlines: May Retail Sales

The Census Bureau publishes a monthly report on U.S. Retail Sales. Data is collected from retailers in most major retail categories, big and small stores, and both traditional and online retailers. The report provides a good snapshot of the state of retail spending overall, and in specific categories. Consumer spending makes up approximately two-thirds of the U.S. economy, so the data provided in the Retail Sales report is a valuable tool to monitoring the health of the consumer.

Retail sales have been a tale of two economies during the COVID crisis. Shopping at grocery stores and other consumer staples outlets remained strong, while gasoline stations, food service, apparel, and other discretionary categories suffered due to the lockdowns. April retail sales were down 16.4% versus March with most categories down in significant double-digits. Online sales were a bright spot and served as a key outlet for consumers during the lockdowns.

Many States and businesses started to re-open in May, so May Retail Sales are likely to be a mixed bag. Evidence of a return to spending across a broader set of retail categories is an important factor toward an economic recovery.

May Retail Sales are scheduled for release on June 16th. Current and previous Retail Sales reports can be found on the Census Bureau website: https://www.census.gov/retail/index.html

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint June 15, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.