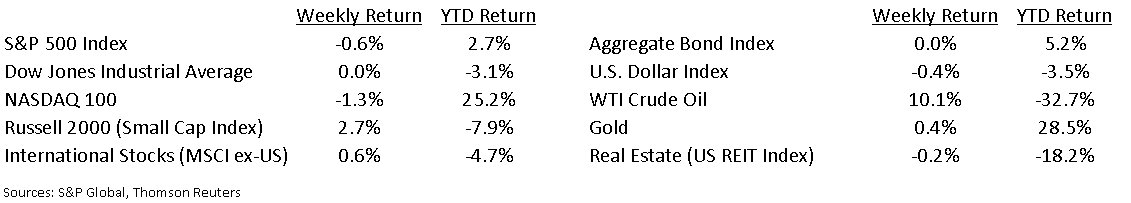

Stocks posted their third consecutive down week. The downside was felt more in the technology and growth-oriented sectors of the market. The S&P 500 Index has declined 5.17% since the beginning of September and the relatively higher technology weighted NASDAQ 100 Index has declined 9.69% over the same time frame.

At its recent meeting, the Fed kept interest rates unchanged and reiterated the pledge to use all tools at its disposal to support employment and price stability. The Fed will continue asset purchases and pledged to keep rates low for several years. The Fed does see relative improvement in GDP for 2020 with a current forecast of -3.7% versus their view of -6.5% from June. The Fed is likely going to remain accommodative even as economic conditions improve to make sure the economic recovery takes hold before being concerned about fighting inflation.

The third quarter reporting season is still several weeks away. Current expectations are for third quarter earnings for the S&P 500 to be down 21.8% year-over-year versus the 30.2% decline for the recently completed second quarter. The current estimate for calendar year 2020 earnings is –19.7% and the estimate for calendar year 2021 earnings is +27.9%.

In our Dissecting Headlines section, we look at how the national unemployment rate of 8.4% breaks out by state.

Financial Market Update

Dissecting Headlines: State Level Unemployment

The August unemployment rate across the U.S. was 8.4%. While higher than the 3.6% January figure, it has also improved significantly from the 14.7% unemployment rate seen in April at the height of the COVID lockdowns.

Sixteen states plus the District of Columbia have higher than average unemployment rates and the remaining 34 are below the national average.

States still under restrictive lockdowns populate the top of the list. This should provide some optimism that job growth should return when these economies fully re-open. Tourist destination states like Nevada and Hawaii have high unemployment rates that are likely tourism / gaming related.

States that re-opened early like Georgia as well as those that never locked down such as South Dakota have well below average unemployment.

Only four states had increased unemployment levels in August versus July: Rhode Island, Kentucky, Arkansas and Missouri.

To keep making strides in employment nationally, the large, heavy hit states such as New York, California, Illinois, and New Jersey need to keep improving. This could happen as those states are able to further ease their COVID-related restrictions.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint September 21, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.