The third quarter reporting season moves into its second big week with 91 companies in the S&P 500 Index scheduled to report earnings. Of the 49 companies that have already reported, 85.7% have exceeded consensus expectations versus the long-term average of 65.1%. This has raised the current forecast for earnings to be down 18.7% year-over-year versus an expectation of down 21.0% heading into last week. While there is still uncertainty from the impact of COVID in the third quarter reporting, we think the expected earnings decline should continue to shrink over the course of the reporting period. The current estimate for calendar year 2020 earnings is down 18.9% and the estimate for calendar year 2021 earnings is growth of 26.3%.

Employment continues to be the most significant data we watch each week to judge the health of the economic recovery from the COVID-induced recession seen the past two quarters. The weekly initial unemployment claims have been sticky in the mid-to-high 800,000 range for the past few weeks. Initial unemployment claims for the week of October 10th were 898,000 versus the previous week at 845,000. Continuing Claims for the week of October 3rd were 10.018 million versus 11.183 million the week prior. The U.S. economy has recovered approximately half the jobs that were lost during the peak of the COVID in the Spring, but still has a long way to go.

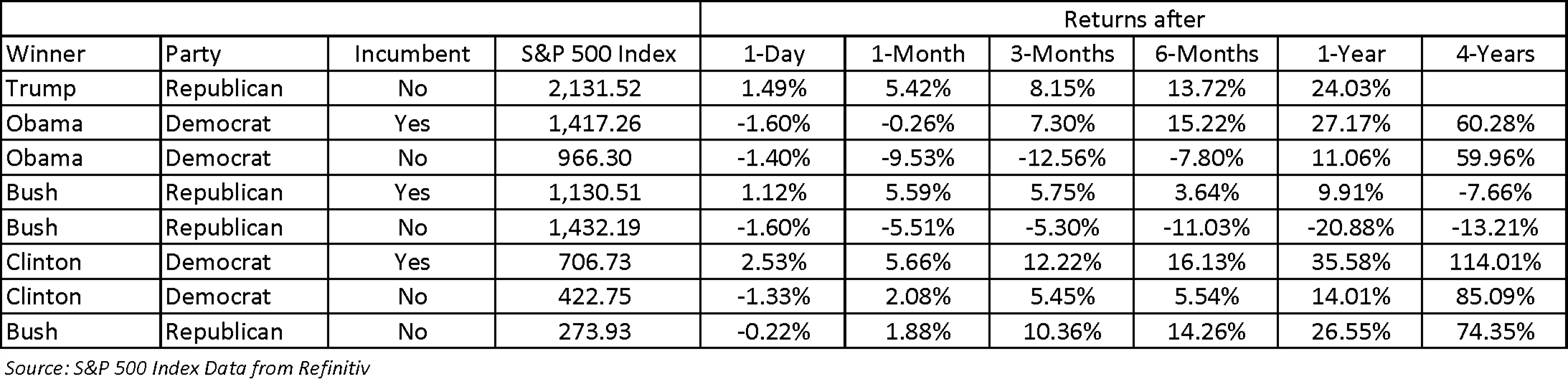

In our Dissecting Headlines section, we look at how the S&P 500 Index has performed during each presidential election.

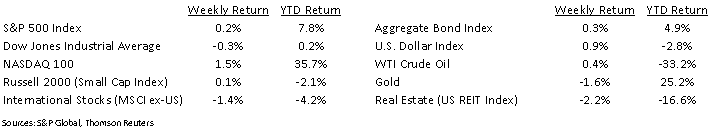

Financial Market Update

Dissecting Headlines: Market Reactions to Presidential Elections

We looked at the returns for the S&P 500 after the past eight presidential elections. The one-day reaction is a mixed bag (5 negative/3 positive), but the one-year returns are all positive except for Bush 43 in 2000, but that is more likely attributed to the 9/11 attacks in Sept 2001. Four-year returns were substantial for all but Bush 43’s two terms.

From a high-level view, our take-away is that the market adjusts to whatever the outcome, and black swan events (9/11 or COVID) and recessions are more likely to impact the market than who specifically is in the White House.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint October 19, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.