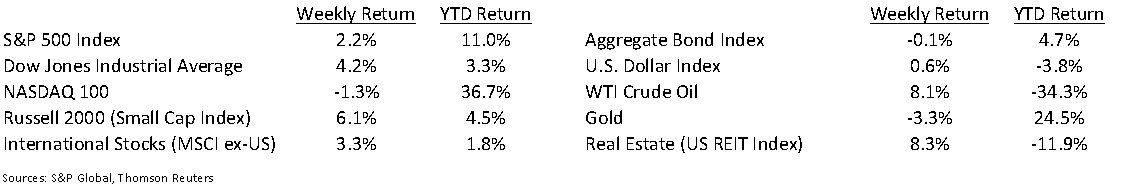

Following a strong post-election day rally the week prior, the S&P 500 Index (+2.2%) and Dow Jones Industrial Average (+4.2%) followed with a second week of gains while the NASDAQ 100 Index retreated modestly (-1.3%). Much of the differential in performance was driven by sentiment that a potential COVID vaccine was imminent which boosted many of this year’s beaten down industries that have suffered from COVID-induced shutdowns such as airlines, lodging, retail, restaurants, and energy. Crude oil rallied 8.1% for the week.

This week holds the last round of significant earnings announcements with the major retailers scheduled to report. In all, 12 companies in the S&P 500 Index are scheduled to report earnings this week. The current Q3 consensus is for EPS to be down 7.4% y/y (versus down 7.8% last week and down 21.7% at the start of earnings season) on a 1.4% decline in revenue. Of the 462 companies that have reported, 84.4% have reported earnings above consensus versus the long-term average of 65.1% and 77.7% have reported revenue above consensus versus the long-term average of 60.3%. The current estimate for calendar 2020 earnings is -15.6% and the estimate for calendar 2021 earnings is +22.9%.

The labor market continues to improve. Initial unemployment claims for the week of November 7th were 709,000 versus the previous week at 757,000. Continuing Claims for the week of October 31st were 6.786 million versus 7.222 million the week prior.

In our Dissecting Headlines section, we look at the change in market sentiment from the American Association of Individual Investor’s weekly sentiment survey.

Financial Market Update

Dissecting Headlines: The AAII Survey

The American Association of Individual Investors (AAII) is an independent, nonprofit corporation formed for the purpose of assisting individuals in becoming effective managers of their own assets through programs of education, information and research. AAII conducts a weekly survey of its members and asks the same simple question each week, Do they feel the direction of the stock market over the next six months will be up (bullish), no change (neutral) or down (bearish)?

The Survey is widely followed as a contrarian indicator for the stock market. When the Survey hits an extreme Bearish stance, the stock market typically is higher both six and twelve months later. Similarly, when respondents are above average Bullish, the market has produced a muted return.

Last week, AAII’s Bullish sentiment rose 17.9 points to 55.8%, its highest level since January 3, 2018. Prior to this week’s reading, bullish sentiment had been at or below its historical average of 38.0% for 35 consecutive weeks. Likewise, Bearish sentiment declined 6.6 points to 24.9%, its lowest level since January 22, 2020. Prior to this week’s reading, bearish sentiment had been above its historical average of 30.5% for 37 consecutive weeks. Continued positive COVID related and reopening news is likely needed to maintain the recent market momentum.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint November 16, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.