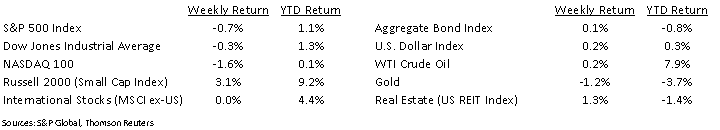

The stock market posted its first down week of 2021. For the week, the Dow Jones Industrial Average declined 0.3%, the S&P 500 Index declined 0.7%, and the NASDAQ 100 Index declined 1.6%. Small cap stocks and oil both posted gains for the week.

We start to move deeper into fourth quarter earnings reports this week with 43 companies in the S&P 500 Index scheduled to report earnings. Of the 26 companies in the Index that have reported quarter-to-date, 96.2% have reported earnings above consensus. Fourth quarter 2020 earnings are currently expected to decline 7.8% year-over-year on a revenue decline of 1.2%. Full-year 2020 earnings are expected to decline 15.1% year-over-year and full-year 2021 earnings are expected to rise 23.9% year-over-year.

Initial unemployment claims during the week of January 9th increased to 965,000 versus 784,000 the previous week. Continuing claims for the week of January 2nd were 5.216 million versus 5.275 million the week prior. Continued improvement in employment is one of the major factors required to sustain economic recovery in 2021.

We are likely to see a flurry of executive orders signed by president-elect Biden once he takes office on Wednesday. The more substantial economic issues, such as further stimulus and a tax plan, will still need to move through the traditional legislative process.

In our Dissecting Headlines section, we look at the recent Fed Beige Book.

Financial Market Update

Dissecting Headlines: Beige Book

Each of the twelve Federal Reserve Banks gather regional data on economic conditions that is released eight times a year in a report titled the Commentary on Current Economic Conditions, more commonly known as the “Beige Book”. The Beige Book provides granular information and anecdotes through interviews with business contacts, economists, market experts, and other sources. It is a qualitative report and meant to characterize current dynamics and identify emerging trends in the economy.

Last week’s Beige Book release indicated that economic activity increased modestly at the end of 2020. Manufacturing improved across almost all districts. Due to varying levels of COVID-19 restrictions, overall economic activity remains mixed across districts. Leisure and hospitality remain weak as some districts increased COVID-related restrictions in December.

While the near-term outlook remains clouded due to COVID restrictions and slow rollout of vaccines, most respondents expected the economy to be back on trend in the second half of 2021

__________________________________________________________

Want a printable version of this report? Click here: NovaPoint January 19, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.