The Federal Reserve acknowledged some improvement in the economy in its Wednesday Federal Open Market Committee (FOMC) meeting statement, while stating that inflation remains below target. The economic improvement versus inflation battle continues in the fixed income and equity markets. This past week “Team Inflation” won as the equity markets declined and bond yields increased. While Federal Reserve Chairman Jerome Powell indicated the Fed doesn’t plan to raise the short-term target rate any time soon, he did comment during the post-meeting press conference that “the data could get strong fairly quickly here”.

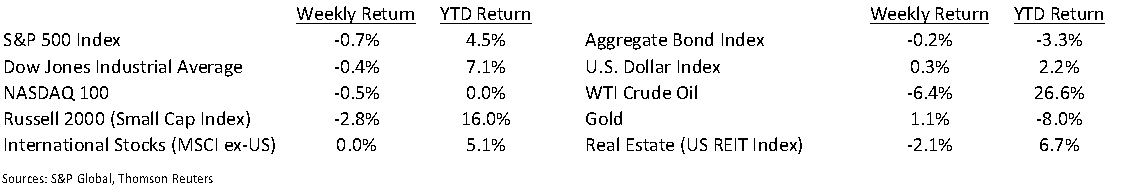

The Dow Jones Industrial Average closed the week –0.4%, the S&P 500 Index was –0.7%, and the NASDAQ 100 Index was –0.5%. The 10-year U.S. Treasury yield moved higher on the week to 1.732% at Friday’s close versus 1.635% the previous week.

Initial unemployment claims for the week of March 13th increased to 770,000 versus the previous week at 725,000. Continuing claims for March 6th were 4.124 million versus 4.142 million the week prior. As a comparison, the weekly average of continuing claims for unemployment were 1.7 million prior to the COVID-induced escalation last year.

As we head into the last full week of the first quarter, the current consensus expectation for first quarter earnings is growth of 22.9% year-over-year and full-year 2021 earnings growth of 24.8%.

In our Dissecting Headlines section, we look at the recent FOMC meeting statement.

Financial Market Update

Dissecting Headlines: Federal Reserve FOMC Statement

Following each meeting of the Federal Reserve’s Federal Open Market Committee (FOMC) a statement is released. The statement is heavily scrutinized by investors and market watchers for clues to the FOMC’s intentions for interest rate policy and open market operations.

The statement for this past Wednesday’s meeting indicated the Fed sees the economy improving. The updated part of the statement read, “Following a moderation in the pace of the recovery, indicators of economic activity and employment have turned up recently, although the sectors most adversely affected by the pandemic remain weak. Inflation continues to run below 2 percent. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses”.

With unemployment remaining above average and a view that any near-term inflation push is transitory versus long-run, the Fed likely keeps short-term interest rates low for the foreseeable future. That said, Fed Chairman Jerome Powell did indicate in the post meeting press conference that data could always change quickly. The COVID-19 pandemic was a unique event and the economic recovery and policy responses are also likely to be unique.

Both Chairman Powell and Treasury Secretary Janet Yellen are scheduled appear before Congress this coming week and should share some insight on the recovery from the pandemic and where U.S. monetary and fiscal policy goes from here.

__________________________________________________________

Want a printable version of this report? Click here: NovaPoint March 22, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.