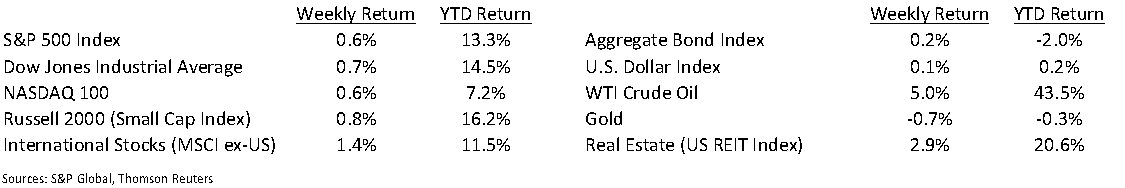

The weaker than forecast employment report rallied stocks and bonds on Friday on the expectation it would keep the Fed on hold. This was despite the Fed’s announcement it would begin selling the excess corporate bonds and ETFs it purchased during the pandemic to stabilize markets. The Dow Jones Industrial Average closed the week +0.6%, the S&P 500 Index was +0.7%, and the NASDAQ 100 Index was +0.6%. The U.S. 10-year Treasury bond yield decreased to 1.560% at Friday’s close versus 1.593% the previous week.

We are in the lull between earnings reports currently. Most of the news driving markets for the next few weeks is likely to be economic data. Later this week, the May Consumer Price Index is scheduled for release and the Producer Price Index follows next week.

The May employment reports showed an increase of 559,000 jobs. This was lower than the 720,000 new jobs forecast for the month. The leisure and hospitality sector continues to recover with 292,000 net new jobs in May. The unemployment rate declined to 5.8% from 6.1% the previous month. The weekly data showed initial unemployment claims for the week of May 29th decreased to 385,000 versus the previous week at 405,000. Continuing claims for May 22nd were 3.771 million versus 3.602 million the week prior.

In our Dissecting Headlines section, we look at how a Federal Reserve taper action would unfold.

Financial Market Update

Dissecting Headlines: Federal Reserve Tapering

The Fed announced it plans to begin selling the portfolio of corporate bonds and bond ETFs purchased last year as part of its efforts to keep financial markets functioning during the shutdown of the economy. The Fed’s statement said the portfolio sales will be gradual and orderly, and “will aim to minimize the potential for any adverse impact on market functioning”. The New York Fed plans to announce more details before sales begin. The Fed holds approximately $8.6 billion in corporate bond exchange traded funds (ETFs) and $5.2 billion of individual corporate bonds.

One mandate of the Federal Reserve is orderly functioning of the financial system. During the early days of the pandemic, the Federal Reserve began a quantitative easing program that entailed the Fed purchasing $120 billion of bonds each month on the open market. This program supplied liquidity to the financial system, allowing banks to loan, companies to issue bonds, and the federal government to issue debt to provide direct payments to certain citizens as a means of stimulating the economy.

The buying of corporate bonds and ETFs was unique to the COVID-19 crisis, so the Fed is seeking to take that layer of extraordinary purchases off the balance sheet. The Fed will eventually decide to taper the amount of treasury and agency bonds it purchases each month. It will also eventually reduce the reinvestment of periodic interest and principal payments received on the bonds held on the Fed balance sheet. Lastly, it will sell some quantity of the treasury and agency bonds it holds to reduce the size of its balance sheet. At that point, a shift in monetary policy will likely have taken place as well with an increase in short-term interest rates since the economy will have fully recovered from the crisis period.

________________________________________

Want a printable version of this report? Click here: NovaPoint June 7, 2021

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.