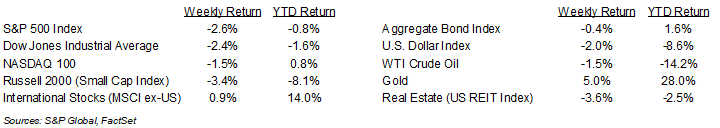

Rising bond yields put a halt to recent momentum in stocks last week. For the week, the S&P 500 Index was -2.6%, the Dow Jones Industrials -2.4%, and the NASDAQ -1.5%. All eleven S&P 500 sectors declined. The Consumer Staples, Communication Services, and Materials sectors declined the least and the Energy, Technology, and Real Estate sectors declined the most. The 10-year U.S. Treasury note yield increased to 4.508% at Friday’s close versus 4.445% the previous week and the 30-year U.S. Treasury bond yield increased to 5.039 from 4.901 the previous week.

Domestic and international negotiations were in the news last week. The House passed the reconciliation bill (aka “The One Big Beautiful Bill”) and that now heads to the Senate. The Trump administration announced tariffs of 50% on the EU for June 1st because talks had stalled but has since delayed them until July 9 as talks are planned to re-start.

The next waypoint for monetary policy comes this week with the April PCE Price Index data scheduled for Friday. This leads to the June 18th Federal Open Market Committee (FOMC) meeting where the committee is expected to keep the Fed funds rate steady in the current 4.25% to 4.50% target range but lay out a policy path for the remainder of the year. Current CME Fed funds futures show a total of 0.50% in reductions forecast for 2025.

The first quarter earnings reporting period is almost complete with 96% of companies having reported results. This week 12 companies in the S&P 500 Index are scheduled to report earnings results. First quarter 2025 earnings growth is currently forecast at 12.9% year-over-year with 4.9% revenue growth. Full-year 2025 earnings are expected to grow by 9.1% with revenue growth of 4.9%.

In our Dissecting Headlines section, we look at items included in the One Big Beautiful Bill.

Financial Market Update

Dissecting Headlines: One Big Beautiful Bill

The House of Representatives passed the reconciliation bill (aka “The One Big Beautiful Bill”). Next stop is the Senate with the goal of having the Bill approved for signature by July 4th. The version from the Senate is likely to see some changes.

Several components of the Bill reflect promises from the campaign trail from the 2024 election, to include an extension of the 2017 tax cuts for all income levels with an increased standard deduction, an elimination of tax on tips and overtime, and increasing deductions for seniors on the social security program. Additional tax benefits include making auto loan interest tax deductible, raising the State and Local Tax Deduction (aka SALT deduction) to $40,000 for people making $500,000 or less, and raising the child tax credit to $2,500 from $2,000 currently. There are also new tax credits for nuclear energy.

Some areas for targeting spending or eliminating tax benefits include elimination of several green energy tax break and ending the electric vehicle tax credit early, starting the Medicaid work requirement beginning in December 2026, eliminating tax benefits for college endowments and private foundations, and changing how pharmacy benefit managers do business with the government.

On the spending side, there is additional money marked for border security and a plan for savings accounts for children funded with $1,000. The bill also raises the debt ceiling by $4 trillion. The debt ceiling issue needs to be resolved by August.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly May 27, 2025

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.