Increased testing for COVID-19 is providing greater knowledge of the extent of the spread of the virus and its lethality. Several biotech and pharmaceutical companies are progressing with the development and testing of potential vaccines. The world keeps moving forward toward a gradual re-opening of social and economic activity. At the same time, Federal Reserve Chairman Jerome Powell has stated that while the economic recovery may take time, that the Federal Reserve will continue to do everything in its power to bridge the economic gap. In the words of one of Chairman Powell’s predecessors Alan Greenspan, there is cause for cautious optimism.

For first quarter earnings, 454 companies in the S&P 500 have reported earnings through last week. Of those reporting, 67% have beaten reduced expectations and 28% have reported below. This week 25 companies in the S&P 500 are scheduled to report earnings. Current consensus is for earnings to be down 12.1% year over year. Second quarter earnings look to be down year over year as well. The pace of economic recovery past midyear should dictate the expectations for earnings growth or contraction over the balance of the year. The stock market tends to anticipate forward earnings potential and is likely looking through the COVID-19 crisis to some extent. Uncertainty over the time required to get back to recent economic activity levels should continue to keep volatility elevated over the next few months.

First-time unemployment claims for the week of May 9th decreased to 2.981 million versus 3.176 for the week of May 2nd. The four-week moving average decreased to 3.617 million. Continuing Claims for the week of May 2nd were 22.833 million, up from 22.377 million on April 25th. Monitoring the eventual decline in continuing claims for unemployment should provide some corroborating evidence of the pace of economic recovery.

In our Dissecting Headlines section we look at what the current economic and social environment means for the summer travel season.

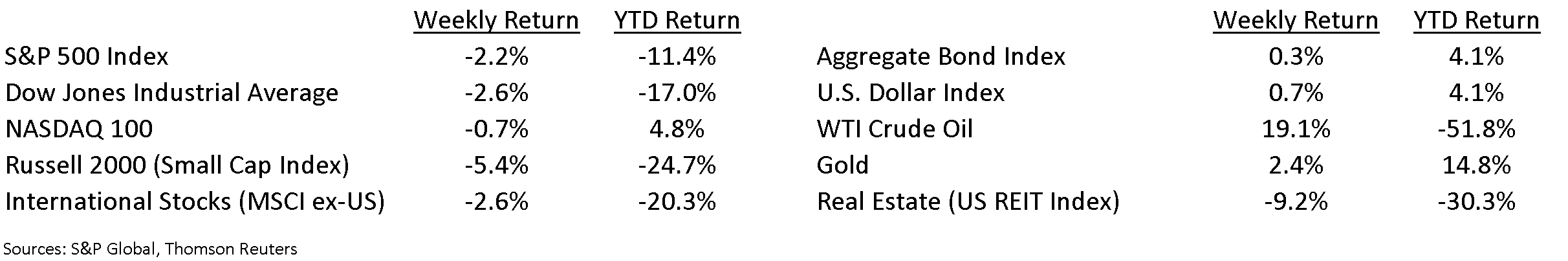

Financial Market Update

Dissecting Headline: Summer Travel Season

Next Monday is Memorial Day in the United States. This marks the start of the traditional summer travel season. With unemployment at record post-World War II levels and restrictions on activities in many states, this is likely to be a opening weekend that reminds many of the “staycations” from the 2008/2009 recession.

For the first time in 20 years, the American Automobile Association (”AAA”) is not issuing a Memorial Day travel forecast. Last year, a vibrant economy had 43 million Americans traveling over the holiday weekend, the second highest in the 20-year period that AAA has been measuring travel for the period.

There is some data indicating a pent up demand for travel building as the COVID-related lockdowns wear on. A survey from Miami-based Overseas Leisure Group shows 72% of Americans are already making plans for their next vacation and 35% would consider a vacation as early as this summer. Eighty-two percent of respondents consider travel to be on pause rather than permanently transformed.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint May 18, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.