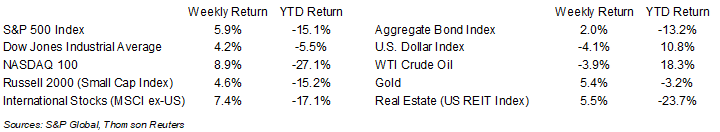

Better than expected Consumer Price Index data let pent up animal spirits run wild last Thursday and Friday. Stocks advanced sharply for the week with the S&P 500 +5.9%, the Dow was +4.2%, and the NASDAQ was +8.9%. The 10-year U.S. Treasury note yield decreased to 3.893% at Thursday’s close versus 4.158% the previous week.

The October CPI was +0.4% month-to-month and core CPI, which excludes food and energy, was +0.3% month-to-month. On a year-over-year comparison, CPI was +7.7% and core CPI was +6.3%. The data was viewed as “cooling inflation” and led investors to sharply shift their bets to a scenario where the Federal Reserve would be less aggressive in its interest rate tightening at the December Federal Open Market Committee (FOMC) meeting.

We are on the downslope of the third quarter earnings reporting period with 460 companies in the S&P 500 Index having already issued their results. This week, 15 companies in the S&P 500 Index are scheduled to report earnings, including many of the major retailers. The current consensus expectation is 4.1% earnings growth on 11.5% revenue growth. For CY2022 earnings growth is currently forecast at 5.8% on 11.2% revenue growth.

In our Dissecting Headlines section, we look at the emergence of animal spirits and the fear of missing out.

Financial Market Update

Dissecting Headlines: Animal Spirits

Animal Spirits is a term coined by British economist John Maynard Keynes in 1936. It is meant to describe how investors make decisions under periods of uncertainty. When fear and pessimism exist, Animal Spirits are weak. When confidence and optimism exist, Animal Spirits are strong. The stock market moves on a combination of data and emotion. The emotion of market participants is Animal Spirits at work.

While there has been an abundance of pessimism present in the investment markets all year, there was also a sense that investors have been perpetually looking for a sign when the Fed would determine its tightening cycle was complete. While the Fed has anchored its inflation expectation to getting the core Personal Consumption Expenditure (PCE) Price Index back toward a 2% level, investors tend to act on the CPI data which is released earlier each month. We have seen high levels of market volatility at each of the past few CPI data releases as investors tend to switch quickly from fear of losing money to fear of missing out when they see positive data push stocks up for a few days.

We believe the FOMC is likely to continue raising rates through the first quarter of 2023, but likely at smaller increments than the 0.75% increases seen at the past four meetings. The FOMC acknowledged that the last meeting that it was time to start making decisions not just on the inflation data but on taking a wider approach to understand on how the cumulative effect of rate increases has impacted the economy. The pace of Inflation is likely to recede in coming months and unemployment is likely to rise, especially the continuation of large layoff announcements. The combination of the two are what should prompt the Fed to exit the tightening cycle.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly November 14, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.