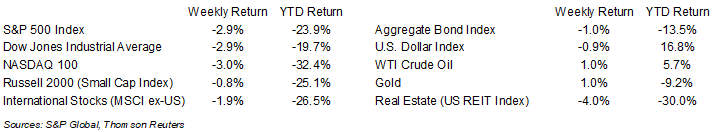

The equity markets closed out their third consecutive down quarter last week. For the week, the S&P 500 was -2.9%, the Dow was -2.9%, and the NASDAQ was -3.0%. The 10-year U.S. Treasury note yield increased to 3.804% at Friday’s close versus 3.697% the previous week. For the third quarter, the S&P 500 Index was -4.9%, the Dow was -6.2%, and the NASDAQ was -4.4%. The U.S. Aggregate Bond Index was -4.0% for the third quarter.

The key data point on this week’s calendar is the September employment report scheduled for Friday. We are likely to see a gradual uptick in unemployment over the coming months as the Federal Reserve’s focus remains on restoring price stability rather than maintaining full employment.

Looking ahead to Q3 earnings, the current consensus expectation is 4.5% earnings growth on 9.7% revenue growth. For CY2022 earnings growth is currently forecast at 7.7% on 11.6% revenue growth. This week four companies in the S&P 500 Index are scheduled to report earnings.

In our Dissecting Headlines section, we look at the recent Personal Consumption Expenditures (PCE) Price Index report.

Financial Market Update

Dissecting Headlines: Personal Consumption Expenditures

The Personal Consumption Expenditures (PCE) Price Index is a measure of price changes for consumer goods and services. Like the Consumer Price Index (CPI), it measures prices of goods and services commonly purchased by households. While the CPI often captures the headlines when it is reported, the Federal Reserve focuses on the PCE as its primary gauge for consumer inflation.

The August PCE Price Index, reported last week, was +6.2% year-over-year and the core PCE, which excludes food and energy prices, was +4.9%. Based on the recent Summary of Economic Projections, the Federal Reserve is targeting the PCE Price Index to get to a +5.4% level by the end of 2022 and core PCE to a +4.5% level. For 2023, the Federal Reserve is forecasting the PCE Price Index at +2.8% versus 2022 and core PCE at +3.1% versus 2022.

Part of the reduction on a year-over-year comparison occurs because we start comparing a moderating inflation environment versus a higher inflation environment. When inflation first spiked, we were comparing a high inflation environment versus a lower inflation environment, so the year-over-year comparisons were steep. The other contributor to lower inflation is a reduction in demand for goods and services as consumers are forced to make choices such as gasoline versus coffee or beef versus chicken. In aggregate, choices and substitutions can help lower prices for certain goods. Lastly, corporations will also likely make economic decisions, such as we have seen with hiring freezes and workforce reductions. Slack in the labor market can help reduce the rate of inflation as lower compensation creates a lower level of labor price inflation that needs to be passed along to consumers.

________________________________________

Want a printable version of this report? Click here: NovaPoint October 3, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.