A strong post-election day rally boosted the major equity indices last week. The NASDAQ 100 Index was +9.4%, the S&P 500 Index was +7.4%, and the Dow Jones Industrial Average was +6.9%.

The Federal Reserve’s Federal Open Market Committee kept short-term interest rates steady in its 0% to 0.25% target range. The FOMC acknowledged the economy is continuing to recover but that it is still below pre-COVID levels. The Fed has used many of its monetary policy tools to stimulate the economy and keep the financial system functioning. Chairman Powell has urged Congress to do more for fiscal stimulus.

The earnings reporting season is rolling on and actual results are generally coming in ahead of expectations. The current third quarter consensus is for earnings to now be down 7.8% year-over-year (versus down 10.2% last week and down 21.7% at the start of earnings season) on a 2.5% decline in revenue. Of the 445 companies that have reported, 85.4% have reported earnings above consensus versus the long-term average of 65.1%, and 78.6% have reported revenue above consensus versus the long-term average of 60.3%. The current estimate for calendar 2020 earnings is -16.0% versus -17.5% last week and the estimate for calendar 2021 earnings is +23.2% versus +24.9% last week. The shrinking decline for 2020 is also causing a modest shrink in the relative gain predicted by analysts for 2021.

The labor market continues to improve. Initial unemployment claims for the week of October 31st were 751,000 versus the previous week at 758,000. Continuing Claims for the week of October 24th were 7.285 million versus 7.823 million the week prior. The October employment report showed 638,000 new jobs added for the month and the unemployment rate at 6.9%.

In our Dissecting Headlines section, we review the differences between monetary policy and fiscal policy.

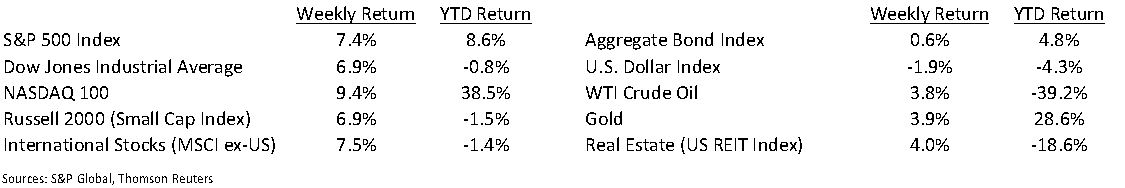

Financial Market Update

Dissecting Headlines: Monetary Policy and Fiscal Policy

The Federal Reserve manages its part of the economy via Monetary Policy. This includes setting short-term interest rates and controlling the supply of money, or liquidity, in the economy. Through the COVID, the Fed used its monetary policy authority to reduce short-term interest rates and inject liquidity into the financial system via bonds purchases. The Fed can act swiftly since it is independent and requires no drawn-out negotiations.

The Administration and Congress engage in Fiscal Policy. This includes tax and spending policy. The negotiation for additional fiscal stimulus grounded to a halt prior to the election. Fed Chairman Jerome Powell has urged Congress to pass additional fiscal stimulus measures.

The Fed can employ Monetary Policy but requires the Administration, Senate and House of Representatives to work together on Fiscal Policy.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint November 9, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.