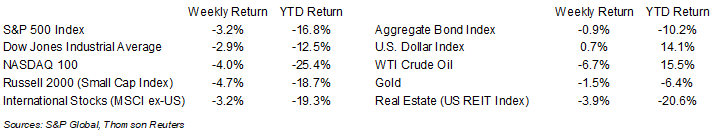

Equities both ended August and began September on a down note. Friday’s employment report from the labor market showed a still healthy labor market, which investors viewed as a signal the Federal Reserve would be diligent with rate increases during upcoming Federal Open Market Committee (FOMC) meetings. The S&P 500 was -3.2% for the week, the Dow was -2.9%, and the NASDAQ was -4.0%. The 10-year U.S. Treasury note yield increased to 3.191% at Friday’s close versus 3.110% the previous week.

The economy generated 315,000 net new jobs in August. This was slightly ahead of the consensus expectation of 300,000 jobs. Within industries, professional and business services and education and health services led the way, each with 68,000 new jobs, followed by retail with 45,000, and leisure and hospitality with 31,000. The manufacturing sector added 22,000 jobs and the construction sector added 16,000 jobs. The unemployment rate rose to 3.7% from 3.5% in July, as the labor force participation rate increased.

We are wrapping up the very end of the second quarter earnings season. For the 496 companies in the S&P 500 Index that have reported earnings for the quarter, 77.4% have exceeded consensus estimates. The current consensus for second quarter earnings growth is 8.5% on 13.6% revenue growth. With only four companies left to report, earnings should end at about the current forecasted level. This compares to an initial expectation of 5.6% earnings growth on 10.4% revenue growth when the earnings period began in July. For third quarter earnings, the current consensus expectation is 5.1% earnings growth on 9.8% revenue growth. For calendar year 2022, earnings growth is currently forecast at 7.9% on 11.7% revenue growth. This week two companies in the S&P 500 Index are scheduled to report earnings.

In our Dissecting Headlines section, we countdown to some significant events between now and year-end.

Financial Market Update

Dissecting Headlines: The Days

With Labor Day marking the unofficial end of summer, we turn our attention to the major events that could impact the economy and markets between now and year-end.

The next Federal Open Market Committee (FOMC) meeting is scheduled is scheduled for September 20th to 21st. We expect the FOMC to increase the Fed Funds rate by 0.75%, unless there is a significant slowing in the pace of inflation and the economy. After September, the two remaining FOMC meetings are November 1st to 2nd and December 13th to 14th.

We are 55 days from Halloween. This should be the first back-to-normal Halloween since pre-COVID. However, global supply chain disruptions have made cocoa and other candy ingredients scarcer and more expensive. Sounds like a fun-size holiday.

We are 63 days from Election Day. Issues regarding inflation, taxes, and spending should be front-and-center among candidates campaigning for the House of Representatives, Senate, and various State level offices.

We are 79 days from Thanksgiving. Along with all the other inflationary pressures that American consumers have experienced this year, the cost of turkeys is on the rise. A combination of overall food price inflation plus outbreaks of bird flu are sending turkeys to record prices.

We are 110 days from Christmas. Impacts from price inflation and consumer confidence will determine the strength of the holiday shopping season for retailers.

________________________________________

Want a printable version of this report? Click here: NovaPoint September 6, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.