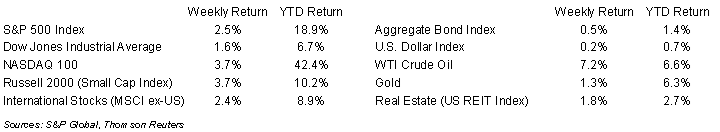

Stocks gained last week after a downward revision to second quarter Gross Domestic Product (GDP) growth and a moderating job market report. The weekly return for the S&P 500 Index was +2.5%, the Dow was +1.6%, and the NASDAQ was +3.7%. The Technology, Materials, and Energy sectors led the market. The Utilities and Consumer Staples sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.173% at Friday’s close versus 4.239% the previous week.

Second quarter GDP growth was revised to +2.1% from its advance estimate of +2.4%. Personal consumption expenditures and government spending were revised up from the advance estimates but were more than offset by a downward revision of private domestic investment.

The August Employment Situation report showed 187,000 net new jobs created versus an expectation of 175,000. The July jobs data was revised lower to 157,000 versus an original level of 187,000. The unemployment rate rose to 3.8% from 3.5% in July as the labor force participation rate rose to 62.8% from 62.6% in July.

The “bad news is good news” reaction lowered bond yields and advanced stocks for the week as these generally weaker reports have investors optimistic the Federal Reserve won’t need to be as aggressive on monetary policy. The current probability for the Federal Reserve to hold rates steady at the September Federal Open Market Committee (FOMC) meeting is 93.0%, up from 86.0% a week ago. The current holiday shortened week is light on economic data. The next area of focus will be on the August Consumer Price Index (CPI) and Producer Price Index (PPI) reports on September 13th and 14th. This is just ahead of the September FOMC meeting on September 19th and 20th.

In our Dissecting Headlines section, we look at the affordability of housing in the United States.

Financial Market Update

Dissecting Headlines: Housing Affordability

Despite the steep increase in mortgage rates, home prices haven’t declined, creating a large affordability gap. Rather than seeing prices fall broadly as we might expect as interest rates rise, transactions have slowed and inventory has declined. July existing home sales (released August 22nd) showed an annual sales pace of 4.07 million homes, down 16.6% year-over-year. The inventory of unsold existing homes was 1.11 million in July, down 14.6% year-over-year. The median home sales price of $406,700 was 1.9% higher than a year ago, despite mortgage rates up to 6.81% at the end of July versus 5.30% a year ago. Mortgage rates have since risen to 7.18% at the end of August.

In a steadier mortgage rate environment, homebuyers would walk up the “property ladder”, buying a larger home as their family and wealth grew. The prospect of abandoning a 3% to 4% fixed rate mortgage on a current home to take on a 7% mortgage for a new home is just not economical.

This is crowding out first time homebuyers trying to secure their first rung on the property ladder. Data from the National Association of Realtors shows that in the second quarter of 2023 the median price of a starter home was $342,200 and would require qualifying income of $96,576 to afford versus the current median income of first time homebuyers of $59,326, a significant gap in affordability.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly September 5, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.