An upside surprise to the June employment report last week tempered expectations that the Federal Reserve would be reducing short-term interest rate at the July FOMC meeting. The Labor Department reported that Non-Farm Payrolls increased by 224,000 in June versus an expectation of 160,000. This was a sharp reversal from May’s disappointing jobs report that raised expectations of a rate cut.

The Dovish posture of the Federal Reserve had been in reaction to uncertainty caused by international trade issues and their impact on economic growth. We may get some insight into what the Federal Reserve is thinking this week. Fed Chairman Jerome Powell is giving the keynote address at the Federal Reserve Conference in Boston on Tuesday and then testifies to the House Financial Services Committee on Wednesday and Senate Banking Committee on Thursday. Additionally, the minutes of the June FOMC meeting will released on Wednesday.

Investor focus should start to shift to quarterly earnings reports. A few big companies, to include PepsiCo and Delta Airlines, report this week and the earnings calendar is full the following week with most of the major banks and other large companies reporting. The current consensus expectation is for S&P 500 companies to report flat earnings year-over-year and for revenue to grow 3.4% year-over-year. We will update the progress of earnings over the next few weeks.

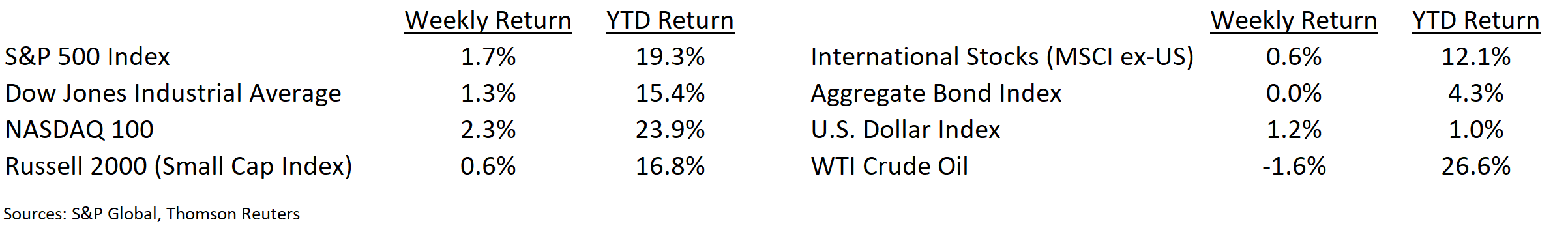

Financial Market Update

Dissecting Headlines: Consensus Earnings Estimates

A headline from April 24th stated “Microsoft reports $1.14 earnings versus $1.00 consensus.” Who is consensus and why does it matter?

Part of investors’ view if a company has had a good or bad quarterly earnings report is how the earnings compare to consensus estimates. Most major banks and brokerage firms have research analysts that publish their estimates for companies in different industries. These estimates are collected by market data providers and consensus estimates are published. These are the benchmarks that news services use to compare how a company’s earnings compare to what was expected.

For large companies there are 25 or more analysts contributing to the consensus estimate, so the consensus number is a reasonable view of what a large group of analysts think. For smaller companies, there may be only one or two analysts, so the consensus may be an average of two disparate views.

The consensus estimates for all the stocks in the S&P 500 Index are rolled up into expectations for the Index that we mentioned at the top of this report.

Disclaimer: Both Microsoft and PepsiCo are owned in the NovaPoint Dividend Growth Strategy.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint July 8, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.