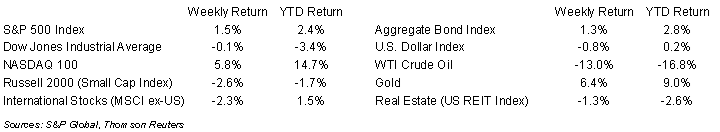

The equity markets had a volatile week as risk appetite fluctuated with developments in the banking sector. The S&P 500 Index end the week +1.5%, the Dow was -0.1%, and the NASDAQ was +5.8%. The 10-year U.S. Treasury note yield decreased to 3.423% at Friday’s close versus 3.699% the previous week.

The Federal Open Market Committee (FOMC) is scheduled to announce its next monetary policy decision on Wednesday afternoon. The Fed now has the task of balancing its fight against inflation with maintaining stability in the banking system. This makes a 0.25% rate increase likely and prompts an update of its outlook in the Summary of Economic Projections due to the recent developments in the banking system. The Fed started to reduce the size of its balance sheet in June, but needed to increase it last week by about $300 billion dollars to support the Bank Term Funding Program and other liquidity options for the banking system.

Regarding inflation, the February Consumer Price Index (CPI) rose 0.4% month-to-month with core CPI, which excludes food and energy prices, +0.5%. Year-over-year CPI increased 6.0% and core CPI increased 5.5%. Shelter costs remained inflationary, rising 0.8% month-to-month and 8.1% year-over-year. The Producer Price Index (PPI) showed more moderation with February PPI declining 0.1% month-to-month and core PPI rising 0.2%. Year-over-year PPI increased 4.6% and core PPI increased 4.4%.

Following the closures of Silicon Valley Bank and Signature Bank, eleven major banks put deposits into Republic National Bank this past week. The latest banking development over the weekend was the announcement that UBS will be acquiring Credit Suisse at the insistence of the Swiss government.

In our Dissecting Headlines section, we look at the potential revisions for the quarterly Summary of Economic Projections that the FOMC is scheduled to release on Wednesday along with its interest rate decision.

Financial Market Update

Dissecting Headlines: Summary of Economic Projections

The FOMC publishes its Summary of Economic Projections each quarter. This is the collective roadmap for how Federal Reserve officials view the economy unfolding over the next two to three years and what monetary policy actions they view as likely based on these economic projections. The projections are updated at the FOMC meetings each March, June, September, and December.

The key data points in the summary include Gross Domestic Product (GDP) growth, unemployment, and inflation measured by Personal Consumption Expenditures (PCE) prices. The summary also shows the FOMC’s projected path of monetary policy in changes to the fed funds rate. The past few summaries showed quarterly adjustments of more persistent inflation and incrementally higher interest rates with the current terminal fed funds rate target range of 5.00% to 5.25%.

The upcoming summary should help us understand the FOMC’s view on the impact of the recent banking system issues and its projected impact on the economy. It should also show whether the FOMC keeps moving forward on a path of higher interest rates to curb inflation as indicated by an increase in the terminal fed funds rate, or if it takes a more cautious view and leaves the current terminal rate unchanged as it balances the task of fighting inflation with the task of maintaining stability in the banking system.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly March 20, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.