A breakdown in US – China trade talks and some saber rattling with Iran dominated headlines this past week. Investors appear to be growing weary of the headline noise, especially with China. The thought that a conclusion to China trade is no longer a “done deal” is inserting some pessimism into investors’ psyche.

This change in sentiment is reflected in the American Association of Individual Investors (AAII) Weekly Investor Sentiment Survey. For the May 15th survey, the percentage of respondents who are Bullish dropped and Bearish spiked from the previous week. The most recent survey saw Bullish sentiment drop from 43.1% to 29.8% in a week and Bearish sentiment rise from 23.2% to 39.3%. The historical average Bullish response is 38.2% and Bearish response is 30.3%.

From AAII, “Both bullish and bearish sentiment experienced their largest weekly changes since last December. At current levels, bullish sentiment is near the bottom of its typical range while bearish sentiment is near the top of its typical range”.

The Survey has typically been a contrarian signal in the market, so pessimism may present opportunity. In late December 2018, the Bullish sentiment was 20.9% and Bearish was 50.3%. We subsequently saw the S&P 500 rise 14.1% YTD through this past Friday.

Heading into the tail-end of the earnings season, earnings reports continue to have a positive surprise +6.1% above consensus. For the S&P 500, 460 out of 500 companies have reported with 75% beating expectations, 6% matching and 18% below expectations. The combined (reported and estimated) earnings growth for the first quarter now stands at +1.4% versus -2.3% five weeks ago. Most of the remaining companies are retailers, so we should hear some commentary on the health of the consumer and the potential impact of tariffs.

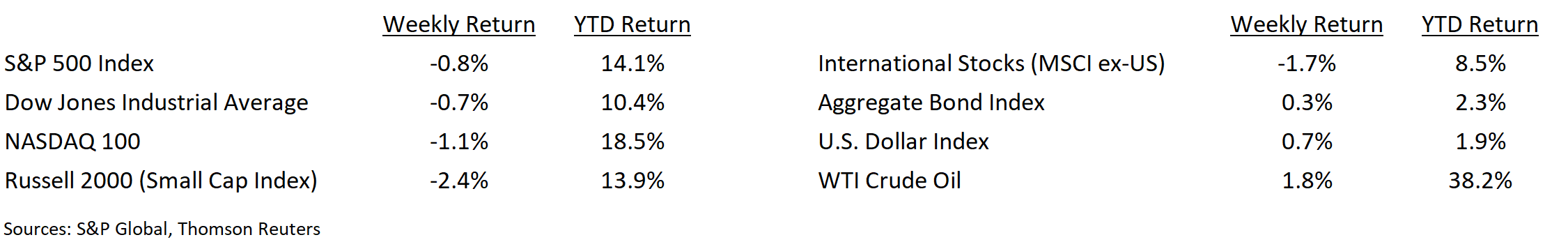

Financial Market Update

Dissecting Headlines: AAII Investor Sentiment Survey

The American Association of Individual Investors (AAII) is an independent, nonprofit corporation formed for the purpose of assisting individuals in becoming effective managers of their own assets through programs of education, information and research. AAII conducts a weekly survey of its members and asks the same simple question each week, Do they feel the direction of the stock market over the next six months will be up (bullish), no change (neutral) or down (bearish)?

The Survey is widely followed as a contrarian indicator for the stock market. When the Survey hits an extreme Bearish stance, the stock market typically is higher both six and twelve months later. Similarly, when respondents are above average Bullish, the market has produced a muted return.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint May 20, 2019

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.