The world bid farewell to the disruptive year of 2020 and an optimistic hello to 2021. All the uncertainty hasn’t disappeared simply because of the calendar transition, but there is a sense of optimism that 2021 will be a year of positive improvement in the economy, social and family interaction, and healthcare regarding COVID.

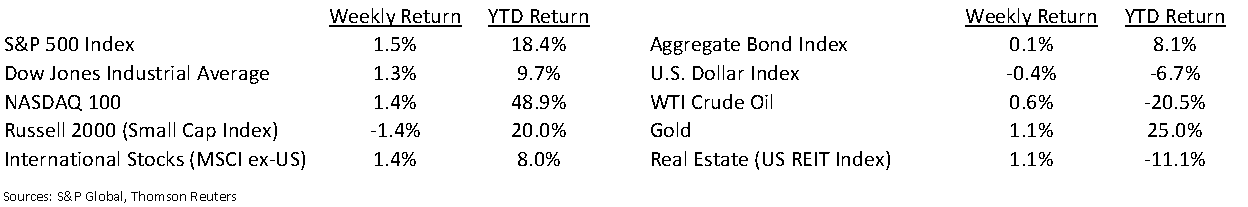

For the final week of the year, the Dow Jones Industrial Average was +1.3%, the S&P 500 Index was +1.5%, and the NASDAQ 100 Index was +1.4%.

Initial unemployment claims during the week of December 26th decreased to 787,000 versus 806,000 the previous week. Continuing claims for the week of December 19th were 5.219 million versus 5.322 million the week prior. Continued improvement in employment is one of the major factors required to sustain economic recovery in 2021.

We will soon be seeing fourth quarter earnings reports and then focusing on an earnings recovery for 2021. Fourth quarter 2020 earnings are expected to decline 10.3% year-over-year on a revenue decline of 1.4%. Full-year 2020 earnings are expected to decline 15.3% on a revenue decline of 3.1%. Full-year 2021 earnings are expected to rise 23.3% on revenue growth of 8.3%.

In our Dissecting Headlines section, we look at annual returns for the S&P 500 Index and how the Index goes up more often than not on an annualized basis.

Financial Market Update

Dissecting Headlines: S&P 500 Annual Returns

A new year can be cause for optimism. For stock market investors this is probabilistically true. Using the S&P 500 Index as a proxy, since 1926 the Index has produced a positive annual return 70-years out of that 95-year span, or 73.7% of the time.

Even a down year shouldn’t be cause for alarm. Multiple consecutive down years happen rarely, and are usually accompanied by a severe economic event such as the Great Depression which witnessed four consecutive down years in 1929 to 1932. The years 1939 to 1941 also saw three-year consecutive declines. More recently, the Index experienced a back-to-back loss in 1973 to 1974 and a three consecutive year loss in 2000 to 2002.

Multi-year market increases are more common with consecutive year increases as long as nine-years happening twice from 2009 to 2017 and 1991 to 1999, and eight-years from 1982 to 1989.

As we saw in 2020, even a severe downturn early in the year can turn into a positive return by year-end.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint January 4, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.