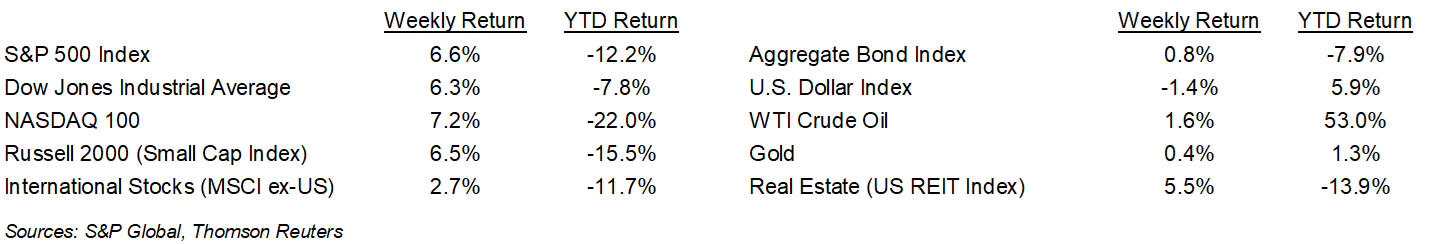

An oversold market greeted some incrementally positive economic news last week and it led the S&P 500 Index to its strongest week of the year. The S&P 500 ended the week +6.6%, the Dow was +6.3%, and the NASDAQ was +7.2%. The 10-year U.S. Treasury note yield decreased to 2.743% at Friday’s close versus 2.788% the previous week.

Investors took some comfort midweek that there were no surprises in the May Federal Open Market Committee (FOMC)meeting minutes that would indicate the Fed is considering any more drastic action than what is already laid out. A further boost to the market came on Friday when the April Personal Consumption Expenditures Price Index (PCE) indicated that some inflationary pressures may have peaked. The April PCE Index slowed to a 6.3% year-over-year increase in prices in April versus 6.6% increase in March. It was the first moderation in the index in a year and a half. The next FOMC meeting is scheduled for June 14th and 15th. The FOMC likely raises the Fed funds rate by another 0.50% at that meeting and future meetings until there is clear evidence that inflation has moderated.

With the first quarter earnings reporting period almost complete, the current consensus for the quarter is 11.2% earnings growth on 13.9% revenue growth versus 6.1% earnings growth on 10.9% revenue growth at the start of the earnings season. For the 488 companies in the S&P 500 that have already reported first quarter earnings, 77.5% have reported earnings above analyst estimates. This coming week seven companies in the S&P 500 Index are scheduled to report earnings.

Looking ahead, the current consensus for second quarter earnings growth is 5.4% and calendar year 2022 earnings growth is currently forecasted to be 9.4%.

In our Dissecting Headlines section, we look at the Personal Savings Rate.

Financial Market Update

Dissecting Headlines: Personal Savings Rate

The income that is left over after people spend money and pay taxes is their personal savings. One data point we get each month from the Personal Income and Outlays report is the Personal Savings Rate. In the three years leading up to the COVID-19 pandemic, the average personal savings rate in the U.S. was 7.6% each month. During the first 12-months of the pandemic (March 2020 to February 2021) that rate spiked to 17.8% due to a combination of government assistance and fewer options for spending, especially in travel and entertainment.

Pent-up demand for travel and entertainment in 2022, along with an inflationary spike in prices, has led to a decline in the rate of savings as consumers have spent the excess savings socked away during the pandemic. The average savings rate during the first four months of 2002 has been 5.3% and the most recent data for April showed a personal savings rate of 4.4%. It is concerning the overall dollar value of savings has declined below $1 trillion for the first time since 2017. The health of the consumer relies on a combination the ability to earn money, manage credit, and save money. This could prompt some consumers to re-enter the work force, seek higher paying jobs, or moderate spending.

________________________________________

Want a printable version of this report? Click here: NovaPoint May 31, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.