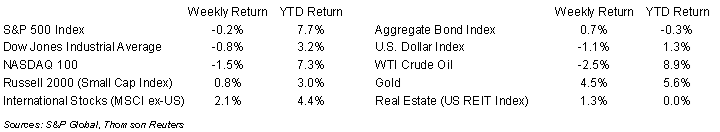

Stocks ended the week on a down note on Friday. For the week, the S&P 500 Index was -0.2%, the Dow was -0.8%, and the NASDAQ was -1.5%. The S&P 500 Index was led by the Utility, Real Estate, and Materials sectors, while the Consumer Discretionary, Technology, and Communication Services sectors lagged. The 10-year U.S. Treasury note yield decreased to 4.074% at Friday’s close versus 4.182% the previous week.

It was a week of both sides of the coin where there was both an optimistic and pessimistic read for each major event. Federal Reserve Chairman Jerome Powell told Congress that the Fed wasn’t ready to lower interest rates yet, but that it is likely later this year. The February Employment Report showed 275,000 net new jobs, well above the 198,000 forecasted, but the January jobs number was revised down to 229,000 from its previous report of 353,000. The economic events keep coming this week with the February Consumer Price Index (CPI) scheduled for release on Tuesday, followed by the Producer Price Index (PPI) on Thursday. CME Fed funds futures imply a 97.0% probability that the Fed keeps the Fed funds rate steady in the 5.25% to 5.50% target range for March. CME futures also show a 74.9% probability that the Fed funds rate does not move at the May meeting. The probability for a first rate cut in June is 57.3%.

The fourth quarter earnings reporting period is near complete with 494 companies in the S&P 500 Index already reported. An additional four companies are scheduled to report earnings this week. Current fourth quarter expectations for the S&P 500 Index are earnings growth of 10.0% and revenue growth of 3.7%. For full-year 2023, S&P 500 Index earnings are expected to grow by 4.1% with revenue growth of 2.4%. For full-year 2024, earnings are expected to grow by 9.7% with revenue growth of 4.6%.

In our Dissecting Headlines section, we explain Triple Witching Day.

Financial Market Update

Dissecting Headlines: Triple Witching

This coming Friday is one of the unique days in the financial markets known as Triple Witching Day. This event happens four times per year on the third Friday of the month ending each quarter: March, June, September, and December. On this day, monthly stock options contracts expire, monthly stock index options expire, and quarterly stock index futures options expire.

The final hour of trading can see higher volume and volatility as traders need to take action ahead of the expirations. This is known as the Witching Hour and where the day gets its nickname. Some traders may need to close out positions, others may roll their positions forward to contracts for the next month or quarter, and others may make offsetting trades in underlying securities. Given the volatility of these derivative contracts, there is an accompanied increase of volatility in the underlying investment instruments such as individual stocks and indices such as the S&P 500 Index.

These one-day movements shouldn’t impact longer-term investors, but it helps to know when these events occur to prevent panicking or reading too much into temporary price movements that may appear detached from underlying fundamentals.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly March 11, 2024

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.