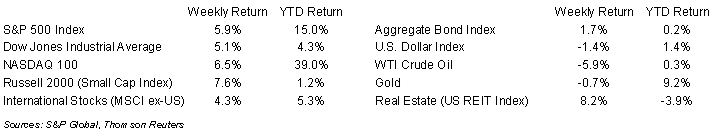

A pause on interest rates at the Federal Open Market Committee (FOMC) meeting followed by a tame employment report helped stocks rally from an oversold condition last week. The weekly return for the S&P 500 Index was +5.9%, the Dow was +5.1%, and the NASDAQ was +6.5%. All eleven S&P 500 sectors were positive for the week, led by the Real Estate, Financials, and Consumer Discretionary sectors. The 10-year U.S. Treasury note yield decreased to 4.558% at Friday’s close versus 4.845% the previous week.

As expected, the FOMC held the Fed funds rate steady in its 5.25% to 5.50% range. While the Committee stated it plans to stay vigilant on inflation, the market is currently pricing no increase in short-term interest rates for the December FOMC meeting with CME futures placing a 90.2% probability the Fed holds rates steady at its last meeting of the year. A tame employment report for October showing only 150,000 net new jobs created versus expectation of 175,000 served to reinforce the premise that the rate increase cycle could be over.

We are on the downslope of the third quarter earnings reporting period with 403 companies in the S&P 500 Index having reported. Another 50 companies are scheduled to report earnings this week. S&P 500 Index earnings are expected to grow by 5.7% year-over-year on revenue growth of 1.2%. This is an increase from the 1.6% earnings and 0.8% revenue growth forecasted at the start of the earnings reporting period. For full-year 2023, S&P 500 Index earnings are expected to grow by 2.4% on revenue growth of 2.0%.

In our Dissecting Headlines section, we look at the two major economic events that moved the market last week, the FOMC rate decision and the October Employment Situation Report.

Financial Market Update

Dissecting Headlines: Economic Review

After a 10% decline from the year’s high at the end of July, the S&P 500 Index rallied last week after another pause on interest rates by the FOMC and a tame employment report. The consensus was likely that the economy was cooling sufficiently for the Federal Reserve to stop raising interest rates, but that the economy wasn’t decelerating too rapidly.

In the FOMC’s official statement, the Committee stated it believes that current tighter financial and credit conditions are likely to weigh on economic activity, hiring, and inflation. It paused on an increase in the Fed funds rate as it needs to take into account the impact of the cumulative tightening of monetary policy including lagging effects which may have not been observed yet. While interest rates may remain higher for longer since inflation is not yet down to the Fed’s 2% target, investors are anticipating the Fed is likely done raising short-term interest rates for this cycle unless there is an inflationary upturn in the economy.

The Fed’s wait-and-see stance was validated on Friday when the October Employment Situation Report showed 150,000 net new jobs created versus an expectation of 175,000. In addition, both the August and September data was revised down by a total of 101,000 jobs. A slowing of employment and spending, coupled with an increase in supply of goods and services is necessary to reduce the high levels of inflation that have plagued the economy since the recovery from the pandemic when there were built-up savings to spend and supply chain disruptions. Last week’s data may have given investors the confidence that things are trending in the right direction.

________________________________________

Want a printable version of this report? Click here: NovaPoint Weekly November 6, 2023

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.