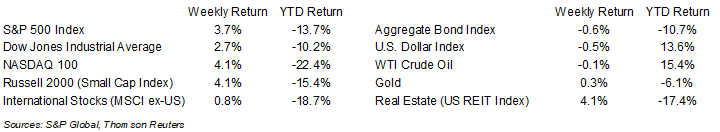

Despite comments from the Federal Reserve that it would keep raising rates until the job is done on inflation, equities rallied during the short four-day trading week. The S&P 500 was +3.7% for the week, the Dow was +2.7%, and the NASDAQ was +4.1%. The 10-year U.S. Treasury note yield increased to 3.321% at Friday’s close versus 3.191% the previous week.

A key economic event to watch this week is the August Consumer Price Index (CPI) report scheduled for Tuesday. Progress on the pace of inflation will be a key input for investors looking to handicap the Fed’s possible move on monetary policy at the September 20th-21st Federal Open Market Committee (FOMC) meeting. Barring any dramatic slowdown in economic activity or price levels, we think the FOMC raises rates by 0.75% at the September meeting.

Looking ahead to third quarter earnings, the current consensus expectation is 5.1% earnings growth on 9.8% revenue growth. For calendar year 2022 earnings growth is currently forecast at 7.9% on 11.7% revenue growth. This week two companies in the S&P 500 Index are scheduled to report earnings.

In our Dissecting Headlines section, we look at some observations from the Beige Book.

Financial Market Update

Dissecting Headlines: Beige Book

Each of the twelve Federal Reserve Banks gather regional data on economic conditions that is released eight times a year in a report titled the “Commentary on Current Economic Conditions”, more commonly known as the “Beige Book”. The Beige Book provides granular information and anecdotes through interviews with business contacts, economists, market experts, and other sources. It is a qualitative report and meant to characterize current dynamics and identify emerging trends in the economy.

Last week’s Beige Book release indicated that economic activity in total was unchanged since early July with five districts reporting modest growth and five reporting modest softening. The overall outlook for future economic growth remained weak, with a view toward further softening of demand over the next six to twelve months.

On the strengthening side, leisure travel was solid with some districts reporting an uptick in business travel as well. The labor market was also strong, with some improvement in labor availability. This coincides with the increase in work force participation seen in the August employment report.

Credit demand was mixed. Financial institutions saw greater demand for credit cards. This makes sense as COVID era financial assistance winds down and household are currently struggling with higher prices on most products and services. Residential loan demand was weaker as higher mortgage rates have slowed home purchase activity.

On the weakening side, residential real estate activity weakened in all twelve districts and residential construction remained constrained by input shortages. Automobile sales also remained weak due to limited inventory and higher prices.

These bottom-up reports from the Federal Reserve districts serve an important view to help qualify the economic activity that is collectively reflected in the larger data points which the Federal Reserve uses in its monetary policy decisions.

________________________________________

Want a printable version of this report? Click here: NovaPoint September 12, 2022

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.