The Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) was passed by the Senate and the House of Representatives and was signed by the President on Friday. If uncertainty about the impact of the coronavirus was centered on the two unknowns of the infection itself and what the government was doing about it, then some clarity has been supplied for the latter. The great unknown remains in the spread of the virus.

The S&P 500 had its first positive week in the past three and investors expressed some optimism regarding the CARES Act as a bridge for the economy while many non-essential businesses remain closed. The impact of business closures can immediately be seen in the weekly claims for unemployment which we highlighted last week as an important metric to watch. This past Thursday, initial claims for unemployment were reported for the week of March 21st with 3.283 million new claims versus 282,000 for the prior week. The four-week moving average increased to 998,000 from 232,000. The increase in initial claims over the next two to four weeks is going to be important to set the bar for how many jobs need to return once the economy recovers post COVID crisis.

As we move into the end of the first quarter of the year, we should get better clarity into the impact of the current environment on many individual companies and industries when companies start reporting their quarterly earnings. We think investors are likely going to be less focused on the impact in the quarter and more likely on what actions companies are taking to operate in the current economic environment.

In our Dissecting Headlines section, we look at Insider Stock Purchases and why they are typically viewed as a positive signal.

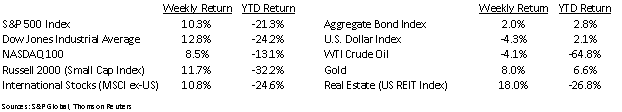

Financial Market Update

Dissecting Headlines: Insider Purchases

Seeing a CEO, Board Member, or other executive of a corporation reaching into their own pocket to purchase stock in their own company has long been viewed as a positive signal. Since corporate officers and board members have greater insight to the operations and plans of their companies, their positive views can be reflected when they decide to purchase stock. Since they have deeper knowledge of their companies, they are required to notify the Securities & Exchange Commission (SEC) when they make decisions to buy or sell, and those are made public through corporate filings with the SEC. There are also periods when they are forbidden to buy and sell stock, known as “black out periods”.

Since insiders are often compensated in stock and stock options in their company, the normal ratio of buying to selling is below 1x as most have stock to sell at some point. The ratio of insider buying to selling is at 1.75x ratio so far in March. With the market well off its highs due to economic concerns over the coronavirus, many corporate insiders are viewing this as a buying opportunity.

Monitoring of insider buying and selling for any specific company can be tracked in their filings with the SEC as well as on many third-party news and web sites.

___________________________________________________________

Want a printable version of this report? Click here: NovaPoint March 30, 2020

To learn more about these topics and our investment strategies, call us at 404-445-7885 or contact us here.

Do you understand your personal investment risk tolerance and the risk of your current portfolio? You can learn these by taking our Risk Analysis Questionnaire.